India projects 0.9% energy surplus but 1.2% peak deficit in 2025-26

Author: PPD Team Date: May 23, 2025

The Central Electricity Authority (CEA) has released the Load Generation Balance Report (LGBR) for 2025-26, projecting a modest all-India energy surplus of 0.9% and a peak power deficit of 1.2%. The LGBR draws on inputs from Regional Power Committees (RPCs), generation utilities, and system operators.

Overview of anticipated demand and supply

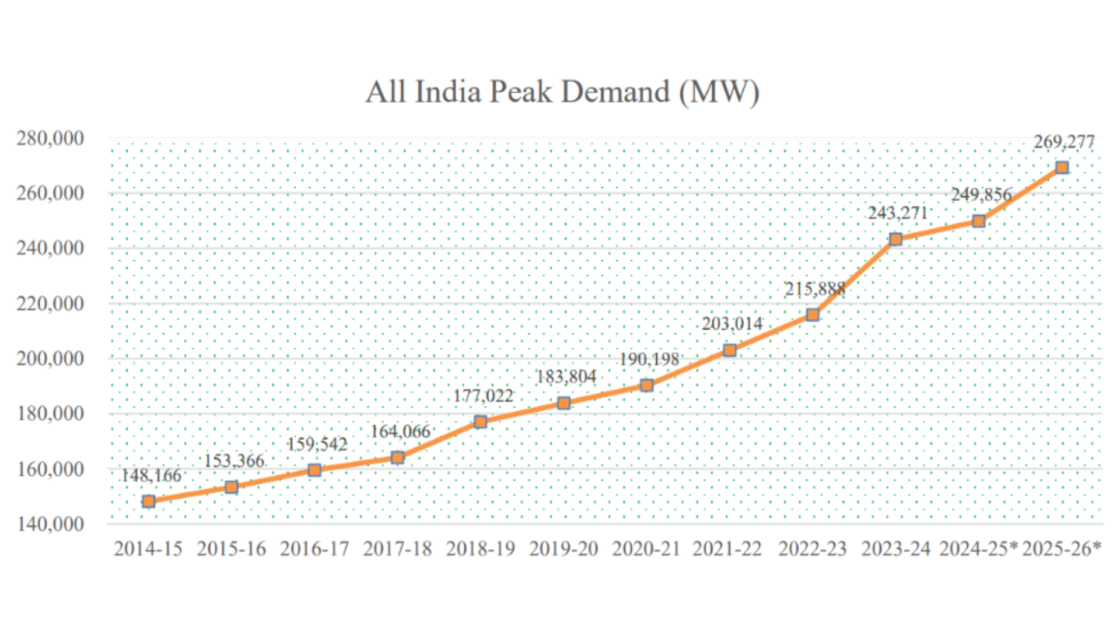

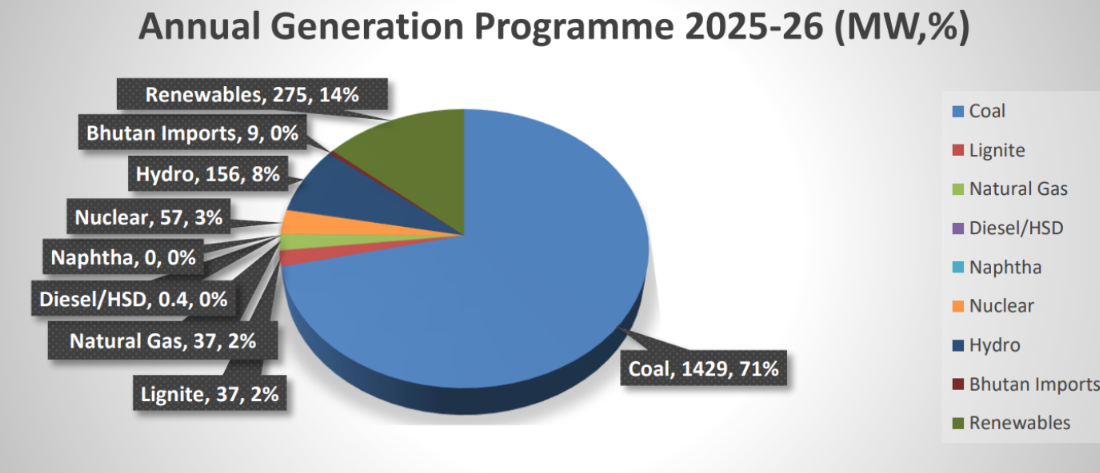

CEA estimates gross electricity generation at 2,000 billion units (BU) for 2025-26, comprising 1,725 BU from conventional sources, including imports from Bhutan, and 275 BU from renewable energy sources. The forecast peak demand is 269,277 megawatts (MW), and anticipated peak availability is 266,006 MW, indicating a national shortfall of 3,271 MW.

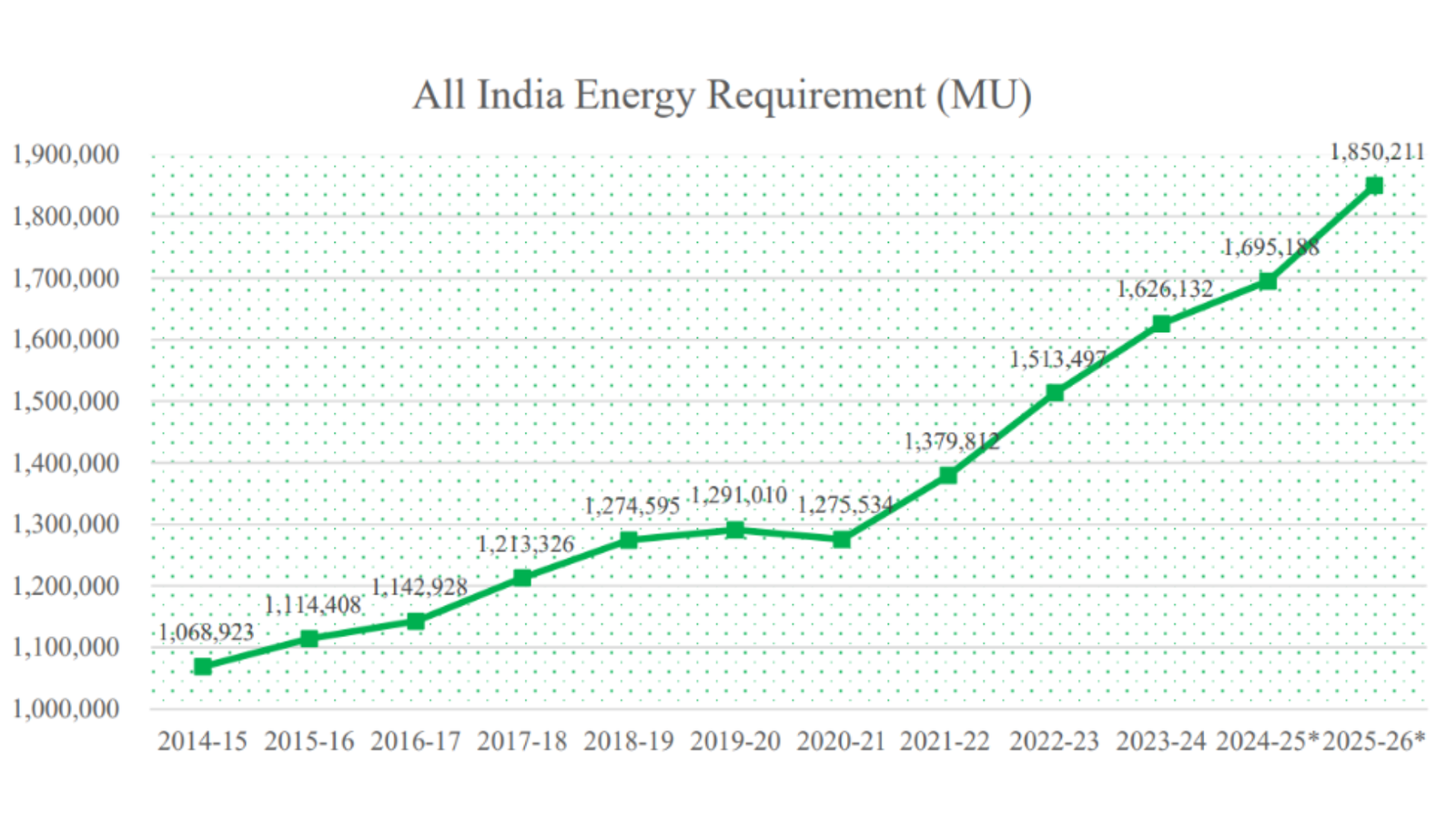

On the energy side, the country is expected to require 1,850,211 MU and have 1,866,007 MU available, resulting in a surplus of 15,797 MU.

Regional power supply positions

The Western Region will have the highest energy requirement at 577,037 MU but a shortfall of 8,216 MU, while the Southern Region shows a slight energy surplus (0.4%) but the largest peak deficit at 6,489 MW (-8.2%).

The Northern Region shows a minor energy deficit of 0.7% and a small peak surplus. The Eastern Region is expected to have a 10.8% energy surplus but a peak shortfall of 3,951 MW (-11.0%). The North-Eastern Region is projected to be surplus in both energy and peak availability.

At the state level, Himachal Pradesh, Puducherry, Sikkim, and Bihar are expected to have significant energy surpluses. In contrast, states like Rajasthan, Punjab, Jammu & Kashmir (including Ladakh), and Telangana will face deficits in both energy and peak supply.

Generation capacity and fuel mix

CEA’s generation plan for 2025-26 includes a capacity addition of 21,315 MW—13,210 MW thermal, 5,205 MW hydro, and 2,900 MW nuclear. Most of this capacity will come from the central sector (11,690 MW), followed by state sector (7,355 MW) and private players (2,270 MW).

The largest share of generation—71% or 1,429 BU—will come from coal-fired plants. Renewables are expected to contribute 275 BU, about 14% of the total. Hydro will contribute 156 BU (8%), while nuclear will add 57 BU (3%).

Planned outages and maintenance

The report includes detailed region-wise schedules for planned maintenance of thermal, hydro, and nuclear units. Maintenance has been optimised to minimise generation outages during high-demand months.

Planned outages have been scheduled so that critical demand periods—particularly during summer and winter peaks—are not affected. This scheduling is coordinated through the RPCs and the Indian Electricity Grid Code.

Mitigation measures for managing peak deficit

Given the anticipated 1.2% peak deficit, CEA and the Ministry of Power plan to implement several measures:

Continued use of imported coal-based plants under Section 11 of the Electricity Act to support grid reliability.

Minimum scheduled maintenance during peak periods.

Enhanced readiness of gas-based power plants to support demand spikes.

Sale of un-requisitioned or surplus power on the market under the Electricity (Late Payment Surcharge and Related Matters) Rules, 2022.

Cross-regional transfers through the National Grid to optimise surplus-deficit matching.

Comparison with 2024-25 outcomes

In 2024-25, the country experienced a smaller-than-anticipated demand-supply gap. Actual energy demand was 1,695,188 MU, while supply was 1,693,599 MU, a shortfall of just 0.1%. Peak demand reached 249,856 MW, and supply matched nearly exactly at 249,854 MW.

CEA had overestimated both demand and availability in the previous LGBR. The deviation in forecasted versus actual figures was 2.3% for energy requirement and 2.6% for peak demand.

Month-wise analysis

Month-wise analysis in the report helps state utilities forecast and plan ahead. Seasonal variations, especially in northern and southern states, play a critical role in managing both energy and peak supply gaps.

The report highlights that surplus states may experience localised shortages during extreme weather events or plant outages, which could be bridged by bilateral contracts or through market-based trading.

Sector-wise and region-wise planned additions

Most new additions in capacity are expected from central government projects. The Western and Southern Regions are projected to see the highest absolute additions in thermal capacity, while hydro additions are concentrated in the Northeast and North.

Nuclear capacity expansion is planned mainly in Maharashtra and Tamil Nadu.

Renewable energy outlook

Renewables are expected to contribute 275 BU, driven by large-scale solar and wind integration. However, the share remains constrained by intermittency and lack of storage infrastructure.

The report notes that grid integration of renewables requires additional balancing reserves, flexible generation sources, and timely completion of transmission projects.

Conclusion

The LGBR 2025-26 underscores India’s improving generation adequacy, while also highlighting peak deficit risks, especially in Southern and Eastern regions. With capacity addition of over 21 GW and increased renewable share, the system is better positioned than in past years.

However, the peak demand-supply mismatch remains a concern. State utilities will need to proactively manage seasonal demand, coordinate outages, and ensure procurement strategies to avoid supply disruptions. The national grid’s role in interregional balancing will be critical.

As India moves towards higher electrification, growing per capita consumption, and renewable integration, such assessments remain essential to maintaining system reliability.

Source: CEA