Global energy jobs reach new highs as growth shifts

Author: PPD Team Date: February 22, 2026

Global energy and renewable employment reached record levels in 2024, with renewable energy jobs rising to 16.6 million and total energy sector employment surpassing 76 million, according to separate reports by the International Renewable Energy Agency (IRENA) and the International Energy Agency (IEA). Both assessments indicate continued expansion but highlight a structural shift, as productivity gains, automation and policy changes moderate employment growth while the electricity sector becomes the largest energy employer.

Renewable energy jobs growth slows

The renewable energy sector employed 16.6 million people worldwide in 2024, up from 16.2 million in 2023, marking a new record but reflecting slower employment growth. IRENA’s Renewable energy and jobs: Annual review 2025, produced with the International Labour Organization (ILO), attributes the deceleration to rising labour productivity and economies of scale that reduce job intensity despite strong capacity additions.

China reported lower renewable employment than the previous year, offsetting gains elsewhere and signalling what IRENA describes as a new phase in the energy transition.

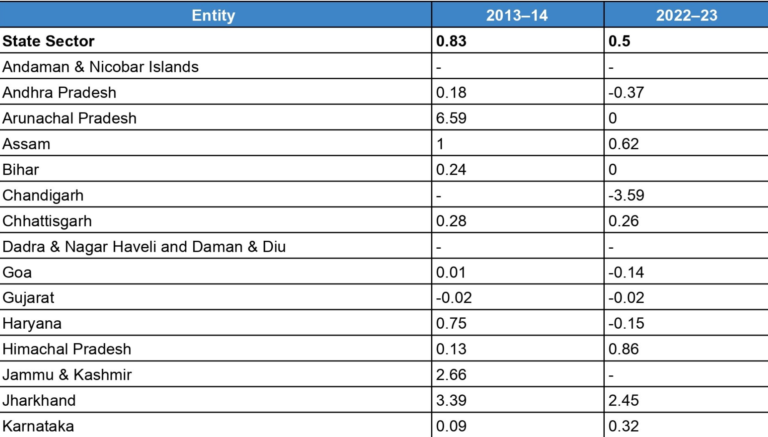

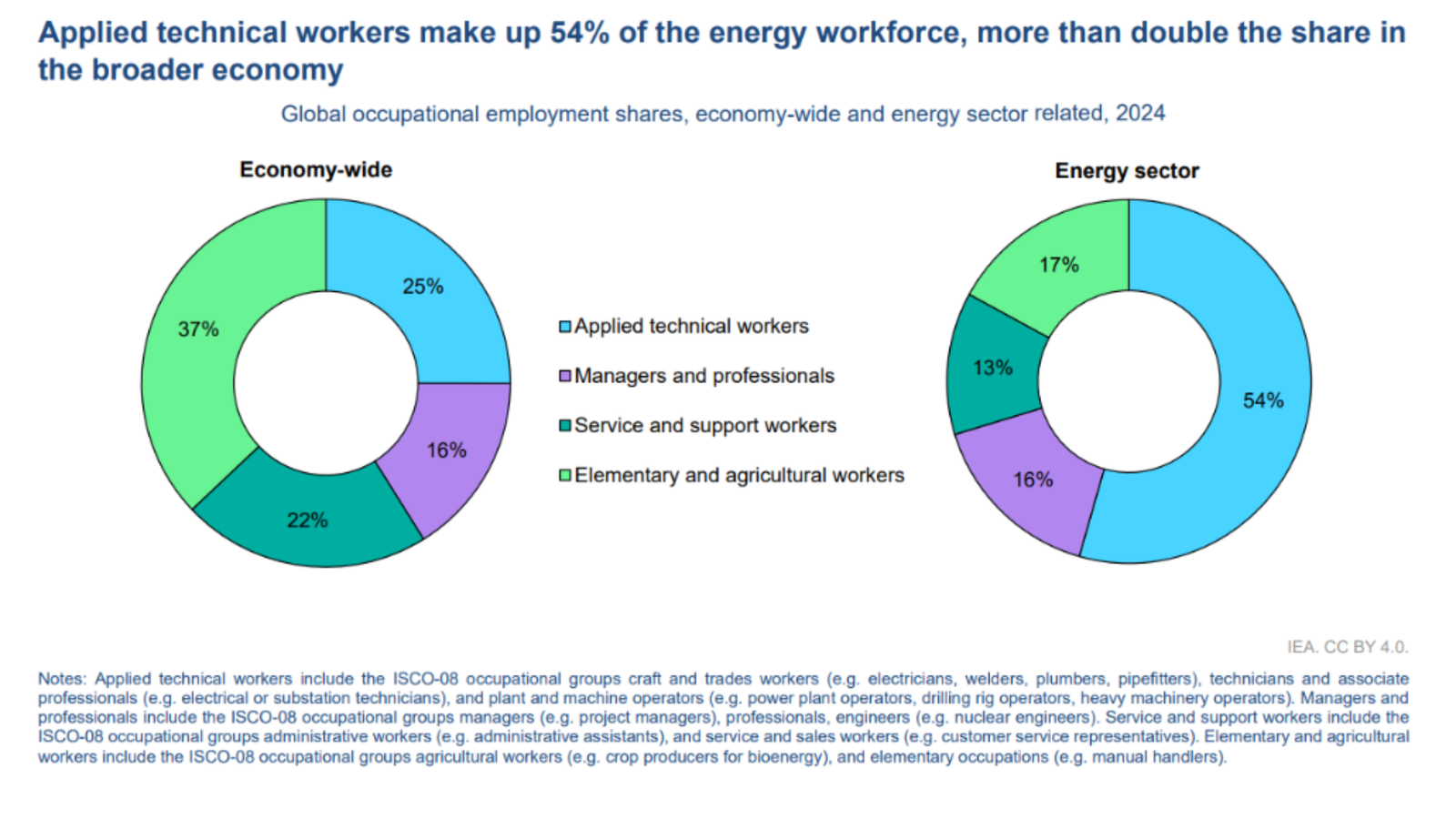

Applied technical workers account for 54% of the global energy workforce, more than double their 25% share in the overall economy. Source: IEA, World Energy Employment 2025.

China’s dominance and employment trends

China remained the largest renewable energy employer with 7.29 million jobs, although this represents a slight decline from 2023. The reduction reflects productivity improvements driven by scale, learning effects and digital technologies such as drones and artificial intelligence that increase efficiency while reducing workforce requirements.

The solar photovoltaic industry employed 4.2 million people in China, down from 4.59 million. Manufacturing accounted for 2 million jobs, while construction, installation and operations and maintenance represented 2.22 million. Five major manufacturers — JA Solar, Jinko Solar, Longi Green Energy, Tongwei and Trina Solar — reduced their combined workforce by 87,000 employees, or 31%, in 2024 amid falling prices and financial losses.

In contrast, China’s wind workforce increased to 1.16 million from 745,000 in 2023, with the country accounting for 61% of global wind employment and adding a record 79.4 GW of wind capacity, equal to 70% of global installations.

Solar PV leads global renewable employment

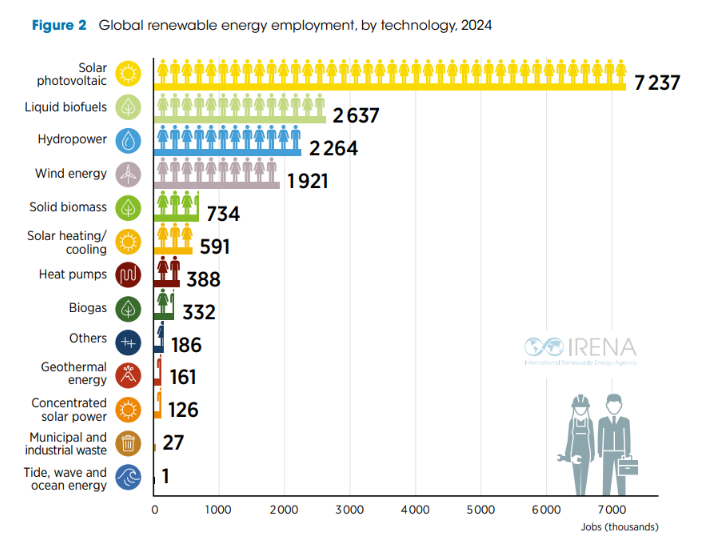

Solar photovoltaic technology remained the largest renewable employer globally with 7.2 million jobs. China accounted for 58% of PV employment, followed by Brazil with 323,800 jobs, India with 384,900 jobs and the United States with 280,100 jobs. European Union member states together employed 764,400 solar workers.

Global renewable energy employment by technology in 2024, with solar photovoltaic leading job creation followed by biofuels, hydropower and wind. Source: IRENA, Renewable energy and jobs: Annual review 2025.

Distributed solar, including rooftop systems, generates nearly three times more jobs per MW than utility-scale projects because of labour-intensive permitting, design and installation. In Brazil, nearly two-thirds of new PV capacity added in 2024 came from decentralised generation.

Liquid biofuels remained the second-largest renewable employer with 2.64 million jobs, concentrated in agricultural supply chains. Brazil led with 762,000 jobs, followed by Indonesia with 750,600 and the United States with 329,700. Hydropower supported 2.26 million direct jobs globally, while wind power employed 1.9 million people.

Regional developments and policy shifts

In the United States, renewable employment reached 1.15 million jobs in 2024, led by solar PV and biofuels. Policy changes have introduced uncertainty, with tax credit provisions under the Inflation Reduction Act requiring projects to begin construction by July 2026 and enter operation by December 2028 to retain eligibility. Offshore wind development faces additional constraints, including a pause on federal leasing and reviews of approved projects.

The European Union employed just under 1.8 million renewable workers. Germany remained the largest employer with 110,000 wind jobs and 127,085 solar jobs. Spain reported around 37,000 wind jobs and 41,000 grid-connected solar jobs, although employment related to residential self-consumption declined.

India added 24.5 GW of solar PV capacity in 2024, supporting 304,300 grid-connected solar jobs and about 80,600 off-grid jobs. Wind employment rose to 67,400 from 52,200 in 2023. Brazil’s renewable workforce reached 1.39 million, driven mainly by biofuels, while the country added 12.9 GW of solar capacity, largely in decentralised generation.

Electricity sector becomes largest energy employer

IEA’s World Energy Employment 2025 report shows total energy employment reached 76 million workers in 2024, increasing 2.2%, nearly double the economy-wide growth rate of 1.3%. Since 2019, the sector has added 5.4 million workers, representing 2.4% of all new jobs globally.

The electricity sector now employs 22.6 million people across generation, transmission, distribution and storage, surpassing fuel supply for the first time. Solar PV has driven half of all power sector job gains since 2019 and added 310,000 jobs in 2024 alone.

Nuclear employment increased by about 70,000 jobs, while grids and storage accounted for roughly one-quarter of new power sector positions since 2019. Wind employment growth slowed due to offshore market challenges, with turbine manufacturing jobs declining 6% in 2024. Transmission, distribution and storage together employed 8.5 million workers, although growth slowed as grid investment lagged generation spending. For every dollar invested in generation, only USD 0.40 is directed to grids, down from USD 0.60 in 2016.

Regional shifts and fuel supply trends

Emerging market and developing economies led employment growth in 2024, with India expanding 5.8%, Indonesia 4.8% and the Middle East 3.5%. China grew 2.2%, while advanced economies added only 0.4%. China now accounts for more than half of global manufacturing employment in heat pumps, electrolysers and wind, two-thirds in electric vehicles, 80% in solar PV and over 90% in batteries.

Fossil fuel supply employment increased by 220,000 to reach 18.4 million, exceeding pre-pandemic levels. Coal supply added 470,000 jobs since 2019 to reach 6.1 million, supported by new mines in India and Indonesia. Oil and gas employment recovered to 12.4 million, although lower commodity prices in 2025 have prompted job cut announcements and an expected 0.8% decline in 2025.

Electric vehicles reshape manufacturing employment

Vehicle manufacturing employment reached 17.5 million globally, with electric vehicle and battery jobs increasing by nearly 800,000 in 2024. In China, almost 40% of vehicle manufacturing jobs are linked to electric vehicles and batteries. Global electric vehicle sales reached 20% market share in 2024, up from 4% in 2020.

Internal combustion engine vehicle manufacturing employment fell by 490,000 in 2024 to 14 million, remaining 17% below the 2017 peak. Electric vehicle manufacturing employment rose 34% year-on-year to 3.1 million, while battery jobs increased to 425,000 from 110,000 in 2015.

Workforce diversity and inclusion

Women account for 32% of full-time renewable energy jobs, higher than oil and gas at 23% and nuclear at 25%, but below the global workforce average of 43.4%. Women remain concentrated in administrative roles, representing 45% of female employment, while they account for 28% of science, technology, engineering and mathematics roles and 22% of medium-skilled positions such as installation and construction.

Across the broader energy sector, women hold around one in five jobs. Representation in senior leadership reached 18% in 2024, up from 13% in 2015, but remains below the economy-wide average of 25%.

The report highlights initiatives to expand workforce participation for persons with disabilities. In Spain, a public-private programme trained more than 300 persons with intellectual and psychosocial disabilities in vegetation management and composting at solar facilities, with nearly 40% securing employment. In Yemen, a United Nations Development Programme initiative provides solar maintenance training using assistive tools. World Health Organization estimates indicate 1.3 billion people globally live with significant disability, yet only three in ten participate in the labour market and those employed earn on average 12% lower hourly wages.

Skills shortages and labour market pressures

More than half of over 700 energy firms surveyed by the IEA reported significant hiring constraints, particularly in applied technical roles such as electricians, pipefitters, power-line workers and engineers. These roles account for 54% of the energy workforce, compared with 25% in the broader economy.

The energy workforce is ageing faster than average. In advanced economies, there are 2.4 workers nearing retirement for every worker under 25. In nuclear, the ratio is 1.7 to 1, and in electricity grids it is 1.4 to 1, compared with 1.2 across the economy.

Demand for applied technical workers grew 16% between 2015 and 2022, while vocational programme graduations increased only 9%. To avoid widening skill gaps by 2030, the number of graduates entering energy would need to rise by about 40% globally.

Industry outlook and structural challenges

IRENA notes that automation and economies of scale reduce labour needs per unit of new capacity, though impacts differ by technology and region. Grid integration challenges leading to curtailment mean installed wind and solar capacity is not fully utilised, lowering operations and maintenance labour requirements.

Manufacturing overcapacity is increasing. Wind turbine utilisation rates declined from 49% in 2023 to 37% in 2024, while solar PV module utilisation stood at 46% in 2024 after 49% in 2023. Price competition is forcing companies to reduce costs, including labour.

Trade measures are reshaping supply chains. United States tariffs on solar imports from Southeast Asia range from 80% for Malaysia to 425% for Thailand, 456% for Vietnam and 696% for Cambodia, influencing manufacturing location decisions.

IEA projects that under current policy settings energy employment will grow by 3.4 million to 4.6 million by 2035. In a net-zero emissions by 2050 scenario, workforce demand would increase by nearly 15 million by 2035. Between now and 2035, two out of every three hires will be required to replace retiring workers. Expanding training capacity to meet demand would cost about USD 2.6 billion annually, less than 0.1% of global public education spending.

Both reports conclude that employment expansion alone is insufficient. A just transition requires focus on job quality, equitable access, skills development and coordinated workforce planning alongside continued growth in clean energy deployment.