Electricity 2026: India’s demand surge, grid strain, and shifting power mix

Author: PPD Team Date: February 22, 2026

The International Energy Agency’s Electricity 2026 report positions electricity as the defining energy vector of the coming decade. Demand growth is accelerating globally, driven by electrification, digitalisation and climate policy. Within this context, India is one of the largest contributors to global electricity demand growth.

India’s power system is expanding at a scale and speed that few other countries can match. The choices it makes over the next five years on generation mix, grid design, flexibility and emissions intensity will materially influence global outcomes. The Electricity 2026 report offers several signals that, when read together, reveal both the opportunity and the strain embedded in India’s electricity transition.

Electricity Demand

After growing by over 6% annually for four consecutive years, India’s electricity demand rose by just 1.4% in 2025. This occurred despite 5.8% growth in demand in the first four months. The early onset of the monsoon in May brought cooler temperatures and higher rainfall, reducing the use of air conditioners and agricultural pumps. Cooling degree days fell by more than 7% compared to 2024, with a particularly steep 12% decline in June, a month that typically accounts for 15% of annual demand.

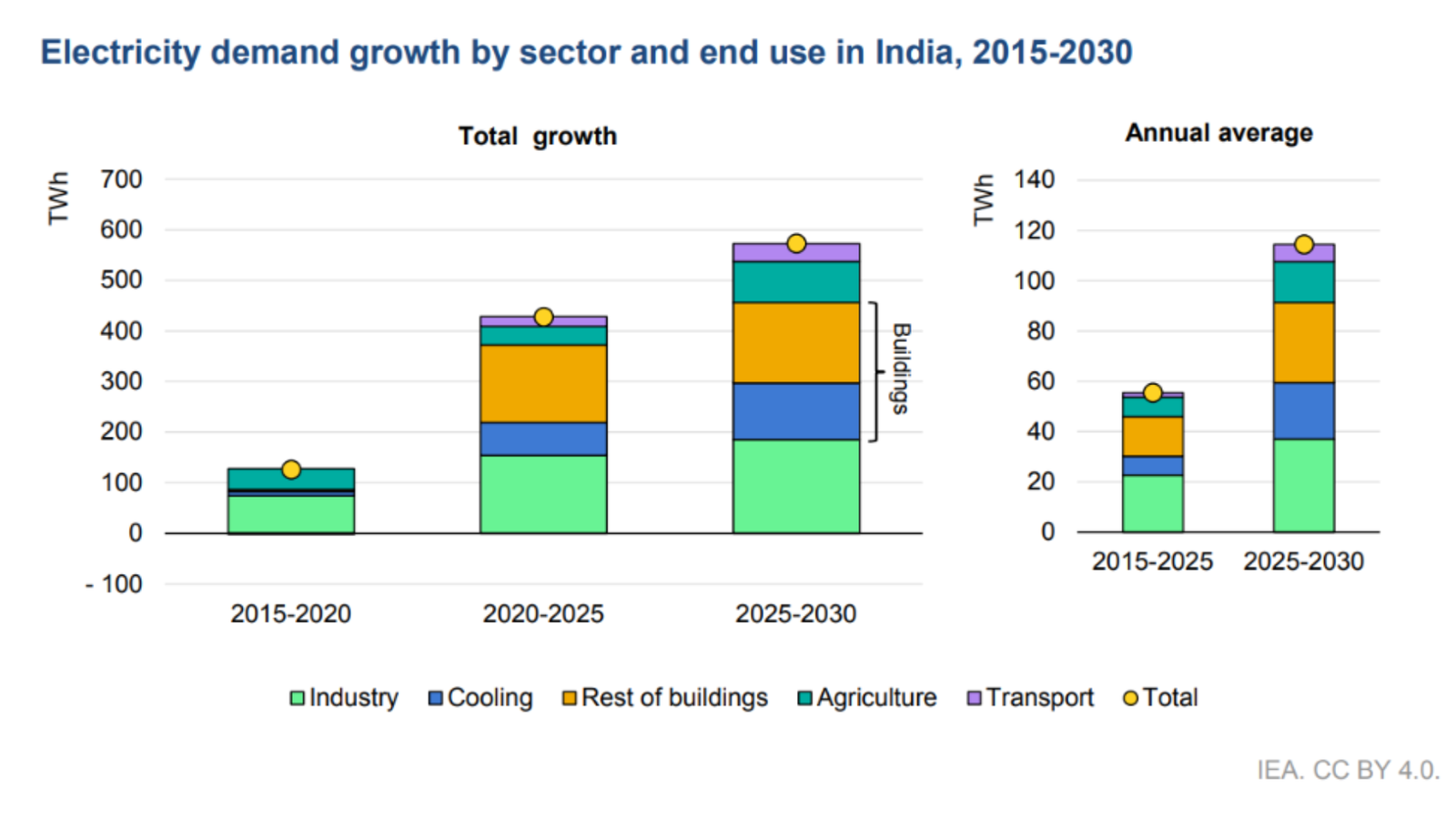

Between 2021 and 2025, India’s net electricity demand increased by nearly 430 TWh. Space cooling contributed 15% to total demand growth and about one-third of the increase in the buildings sector, which alone accounted for half of national demand growth over the period. Industry contributed 36%, while agriculture and transport made up the remainder.

Electricity demand growth by sector and end use in India, 2015–2030. Source: International Energy Agency (IEA), Electricity 2026.

Looking ahead, demand is expected to grow at an average rate of 6.4% per year through 2030, broadly aligned with International Monetary Fund (IMF) gross domestic product (GDP) projections. India is set to add over 570 TWh to annual consumption over the next five years. Industry will contribute roughly one-third of this growth, while the share from households and services is expected to decline slightly. Cooling will account for more than 20% of demand growth between 2026 and 2030, driven by rising AC ownership and usage. Electrification in agriculture and transport will together contribute around one-fifth of total demand growth.

Over the past decade, India’s peak electricity load has risen by 54%, from 162 GW in 2017 to 250 GW in 2024. Peak loads now consistently occur during summer months, driven by prolonged heatwaves, rising cooling demand, and pre-monsoon agricultural activity.

India’s power grid is divided into five regional systems—Northern, Western, Southern, Eastern, and Northeastern—fully interconnected since 2013. Inter-regional transmission capacity now exceeds 120 GW and is expanding under the Green Energy Corridor schemes, supporting the target of 500 GW of non-fossil capacity by 2030.

Peak load patterns vary by region. The Northern Region, which accounts for nearly 30% of national demand, sees summer peaks driven by extreme heat and AC use, with a secondary peak post-monsoon for irrigation. The Western Region benefits from a diversified industrial base, with peaks often occurring in Q4 or Q1. The Southern Region experiences early summer peaks and sustained demand during the monsoon, while the Eastern and Northeastern Regions have lower, more stable loads.

Between 2017 and 2025, peak loads grew by 57% in the Northern and Western Regions, 65% in the Southern Region, 60% in the Eastern Region, and 43% in the Northeast.

Policies such as PM-KUSUM and Time of Day (ToD) tariffs have shifted some evening demand to daytime, aligning it with solar generation. ToD tariffs were mandated for industrial and commercial users from April 2024 and for other non-agricultural users from April 2025, though implementation depends on smart meter deployment. As of December 2025, 22% of approved smart meters had been installed, with wide regional variation. Further rollout will unlock additional demand flexibility.

In early 2025, strong economic activity—6.6% GDP growth, 3.5% industrial production growth, over 10% annual growth in appliance sales, and nearly 50% growth in data centre demand—pushed load curves higher across all regions. In the Western Region, home to states like Maharashtra and over half of India’s data centre capacity, average load at 11 a.m. rose by more than 6 GW (+9%) in February–March.

However, the early and intense monsoon in May 2025 led to cooler temperatures and heavy rains, curbing AC and irrigation use. Nationwide peak load reached 241 GW on 9 June, down from potential highs. In the Western Region, average load at 3 p.m. fell by 7 GW (-10%) compared to 2024.

The moderating effect of weather is especially evident in Uttar Pradesh, India’s most populous state. Between May and June 2024 and 2025, daily peak load trendlines rose by nearly 2 GW. Had summer temperatures matched 2024 levels, peak load could have exceeded 32.5 GW, up from 30.6 GW the previous year. Instead, it remained below 31.5 GW. Since 2017, the sensitivity of peak load to a 1°C temperature increase has quintupled, reflecting rising AC penetration.

In agriculture, which accounts for 16% of Uttar Pradesh’s demand, electrified irrigation pumps are increasingly powered by daytime solar, shifting load from evening to afternoon. High monsoon rainfall reduces pump use, cutting daily peak load by up to 5.5 GW per 1 mm/h of precipitation, a sharp increase from less than 1 GW in 2017.

Resource adequacy plans led by the Central Electricity Authority (CEA) indicate that most states will face significant shortages by 2034, even if all planned capacity is commissioned on time. Further annual procurement of coal, variable renewable energy, and storage capacity will be required. According to the plans, unserved energy in 2030 could exceed 38 TWh (14.9% of demand) in Uttar Pradesh (NR), 20 TWh (10.1%) in Tamil Nadu (SR), 11 TWh (11%) in West Bengal (ER), and 7 TWh (30%) in Assam (NER). Maharashtra (WR) faces a more manageable outlook, with unserved energy projected at just over 3 TWh (1.6%) in 2030.

These projections contrast with recent improvements in supply-demand balances. Between 2017 and 2025, nationwide unserved energy fell by 97% (over 7 TWh), and unmet peak load declined by 78%.

With peak loads rising faster than average demand, planning now emphasises peak load alongside energy requirements. Load duration curves have steepened across regions, reflecting a greater concentration of high demand in fewer hours. In the Southern Region, loads at or above 80% of peak now occur in only 17% of yearly hours, down from two-thirds in 2017. Comparable figures are 15% in the Northern Region and 38% in the Western Region. The reduction in peak-hour outages has contributed to this steepening by eliminating the flattening effect of supply shortfalls.

Despite recent progress, structural growth in demand and peak load, driven by economic activity and cooling needs, will keep adequacy in focus, particularly in the Northern Region. Expanded generation capacity across thermal, renewable, and nuclear sources, improved coal fleet availability, stronger interconnections, demand response, and battery storage will be essential.

Supply and Generation Mix

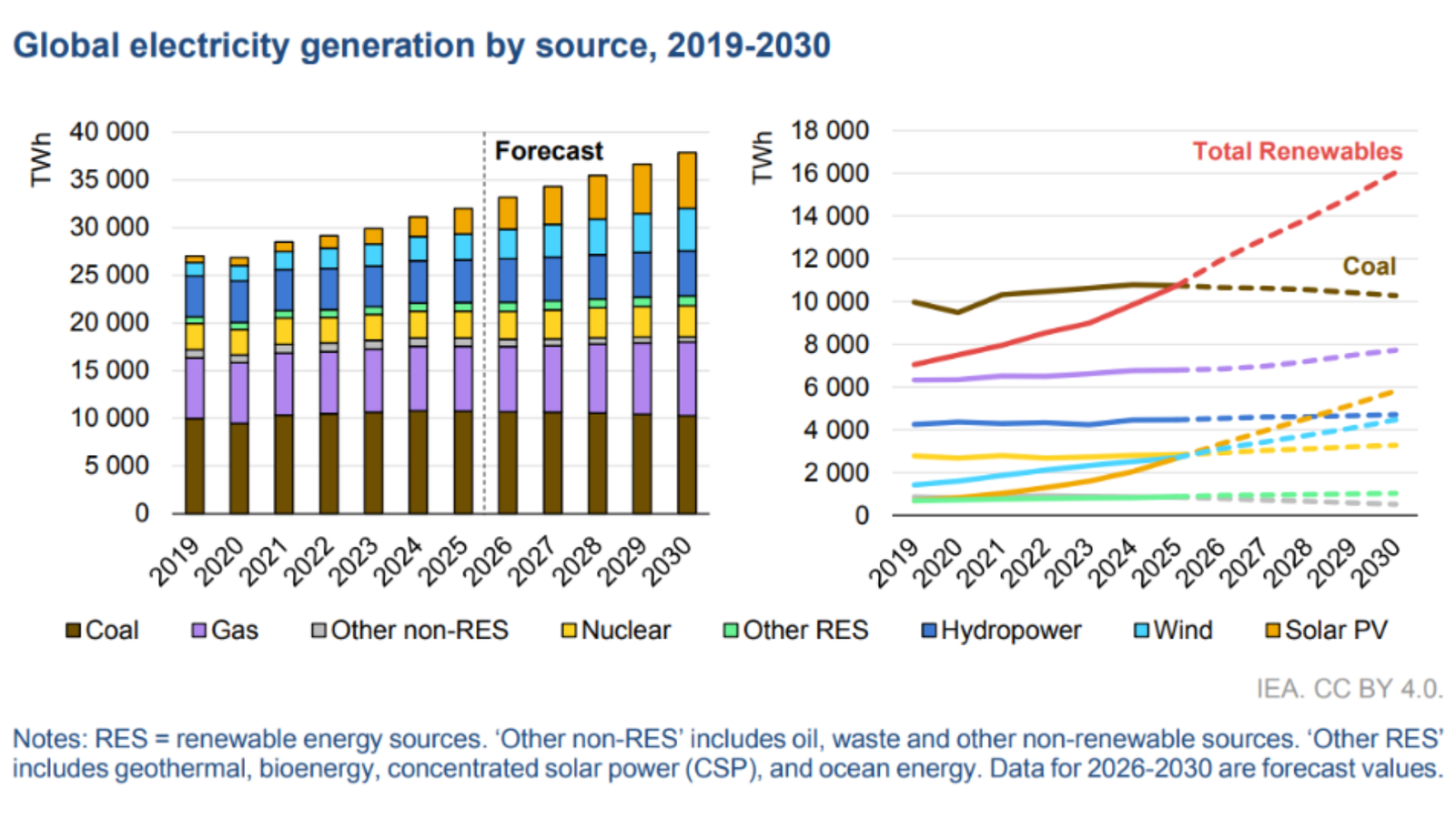

The Electricity 2026 report makes clear that renewables will meet almost all global electricity demand growth through 2030. Solar photovoltaic generation is the single largest contributor, supported by continued cost declines and fast deployment cycles. Wind and nuclear also play important roles, together pushing zero-carbon sources toward half of global electricity generation by the end of the decade.

Global electricity generation by source, 2019–2030. Source: International Energy Agency (IEA), Electricity 2026.

India’s low-emissions energy expansion accelerated sharply in 2025, with renewable generation surging by 20%, the largest absolute annual increase on record. Solar PV led the charge with a 24% year-on-year rise, adding 33 TWh of new output. This marks a significant jump from the already strong 15% growth recorded in 2024. Wind power followed closely with a 28% increase, while hydropower output grew by 14% due to improved hydrological conditions.

In contrast, nuclear generation dipped by 1.6% in 2025. However, this trend is set to reverse dramatically, with nuclear output forecast to grow at an average annual rate of 12% through 2030 as new reactors come online.

With overall electricity demand growing at a relatively modest 1.4% in 2025, the rapid expansion of renewables directly displaced fossil fuels. Coal-fired generation fell by 3.2% following a 5% rise in 2024, while gas-fired output declined by an estimated 9% after growing by 6% the previous year.

Looking ahead to 2030, India’s electricity demand is projected to surge at a robust annual average of 6.4%, driven by continued economic growth. Solar PV is expected to meet half of this new demand, while coal will supply a quarter. This will reshape the country’s power mix significantly: solar’s share of total generation is projected to hit 10% in 2026 and approach 18% by 2030. The share of variable renewable energy (solar and wind) is expected to rise from 14% in 2025 to 24% by 2030, with total renewables surpassing one-third of the generation mix.

Despite the rapid rise of clean energy, coal will remain the dominant source of electricity, though its share is forecast to fall from around 70% in 2025 to 60% in 2030. Coal-fired output is still expected to grow by an average of 2.5% annually to meet rising demand. Gas-fired generation is also poised for a rebound, growing at nearly 10% per year in a more favourable LNG pricing environment.

Grid Stress and System Flexibility

One of the most revealing aspects of the Electricity 2026 report is its emphasis on grids as the critical constraint of the energy transition. The IEA highlights that more than 2,500 gigawatts of generation, storage and large electricity consumers worldwide are currently waiting for grid connections.

To manage its evolving grid, India is advancing demand-side measures. By April 2025, the Ministry of Power mandated time-of-day tariffs for all consumers except agriculture. As of January 2026, approximately 53 million smart meters have been installed. At the state level, Maharashtra has pioneered a “Demand Flexibility Portfolio Obligation,” requiring distribution companies to procure demand-side resources equivalent to 1.5% of the previous year’s peak demand, escalating to 3.5% by fiscal year 2029-30. This mandates utilities to build portfolios of controllable loads to actively reduce peak demand, verified through annual flexibility events.

Prices

India’s wholesale electricity prices fell sharply in 2025, averaging USD 46 per megawatt-hour (MWh), a 16% decline year-on-year in US dollar terms (13% in INR). The drop was driven by a confluence of supply-side and demand factors. Seaborne thermal coal prices hit a four-year low in the first half of the year, significantly reducing input costs for coal-fired power plants, even though prices recovered modestly later in the year.

Market liquidity and competitive pressures intensified as new thermal and renewable capacity came online, compounded by a strong performance from hydropower. On the demand side, an early monsoon arrival and milder temperatures from May through August curbed electricity consumption, limiting the need for expensive peak-time generation. The surge in output from low-emissions sources was so pronounced at times that it pushed wholesale prices to near zero during multiple periods on 25 May and again on 25 August.

Outlook for 2026 to 2030

India’s electricity demand grew just 1.4% in 2025, the weakest rate since 1972, excluding the pandemic, due to mild weather and slower industrial activity. The reprieve is temporary: demand is forecast to rebound 6.9% in 2026 and average 6.4% annual growth through 2030, driven by rising incomes, industrial expansion, and electrification.

Renewable generation surged 20% in 2025, the decade’s strongest increase. Solar PV led with 24% growth, accelerating from 15% in 2024 as costs plunged. Wind rose nearly 28%, hydropower 14% on improved rainfall. Through 2030, solar is projected to average 24% annual growth, adding over 300 TWh, while wind maintains 8%+ yearly gains.

India has already hit its 2030 Paris target, sourcing 50% of installed capacity from non-fossil fuels. Between 2026 and 2030, nearly 300 GW of renewables are expected online, backed by 100 GW of domestic solar manufacturing capacity. The first National Policy on Geothermal Energy was announced in 2025.

With rapid build-out underway, policy is shifting to reliability. New rules mandate Automatic Weather Stations at large renewable projects for accurate forecasting. The India Energy Stack taskforce is building digital public infrastructure to integrate grid data and enhance efficiency. The Revamped Distribution Sector Scheme continues, with 203 million smart meters sanctioned and fiscal incentives for state-level reforms.

The Nuclear Energy Mission targets 100 GW by 2047. The landmark SHANTI bill (December 2025) opens the sector to private participation for the first time. NTPC is entering nuclear via a new subsidiary and a joint venture with state operator NPCIL. Nuclear generation is set to grow 12% annually through 2030.

Coal generation fell 3.2% in 2025 but is expected to resume growth at 2.3% annually through 2030, maintaining a ~60% share of the mix. Gas-fired output, down 9% in 2025, is forecast to rebound nearly 10% yearly on lower LNG prices. Total power sector CO₂ emissions fell more than 3% in 2025, the first decline since 2020.

Conclusion: The Global Picture

The IEA’s Electricity 2026 report depicts a world entering a new phase of electrification. Global electricity demand is growing faster than total energy demand, driven by industry, cooling, transport and digitalisation. Clean electricity sources are expanding rapidly and are on track to supply half of global generation by 2030, allowing emissions from the power sector to plateau. At the same time, grids and flexibility emerge as the critical enablers of this transition. India sits at the centre of these trends. Its electricity system encapsulates the global challenge of scaling clean power quickly while maintaining reliability, affordability and economic momentum in a rapidly growing economy.

The featured photograph is for representation only.