Electricity derivatives: Revolutionizing India’s power market

Author: PPD Team Date: June 12, 2025

Since 2016–17, India has transitioned from being a net importer to a net exporter of electricity. Yet, the sector remains weighed down by long-term power purchase agreements (PPAs). These PPAs offer stability but also limit flexibility.

This article integrates insights from NSE’s Concept Paper on Electricity Derivatives and MCX’s Price Risk Management in the Indian Power Market, alongside details on MCX’s trading framework, to provide a comprehensive analysis of how derivatives are transforming India’s power sector.

The introduction of electricity derivatives—futures and options—is now set to change how risk is managed in India’s electricity market. Approved by the Securities and Exchange Board of India (SEBI), these financial instruments are traded on the National Stock Exchange (NSE) and Multi Commodity Exchange (MCX).

On June 6, 2025, MCX received SEBI’s formal approval to launch electricity derivatives, marking a major step in India’s energy trading ecosystem. These cash-settled contracts, linked to Indian Energy Exchange (IEX) Day-Ahead Market (DAM) prices, allow power generators, distribution companies (Discoms), and large consumers to hedge against price volatility.

Five days later, on June 11, 2025, NSE became the second exchange to secure SEBI’s approval to launch monthly electricity futures contracts. NSE plans a phased rollout, with potential for longer-tenor derivatives like quarterly and annual contracts pending further regulatory nods.

These new offerings create a layer of financial depth for India’s evolving electricity market. They let buyers and sellers protect themselves against price fluctuations while enabling more efficient pricing and planning.

Why India needed electricity derivatives

Electricity pricing in India has long been rigid. PPAs lock in prices and quantities, but that rigidity creates problems when market conditions change.

NSE offers a simple case to understand this: if a Discom has a PPA at Rs 6.1 per unit, but the spot market drops to Rs 4, it pays above-market rates and cannot benefit from the lower prices. Generators face the opposite issue. When spot prices spike to Rs 4,000 per megawatt hour (MWh), they might still be selling at Rs 3,500 due to existing agreements.

Only 6–7% of power in India is traded on exchanges such as the IEX. In contrast, mature markets in Europe see up to 50% of their power traded on exchanges. That gap creates exposure to price swings and limits flexibility for both buyers and sellers.

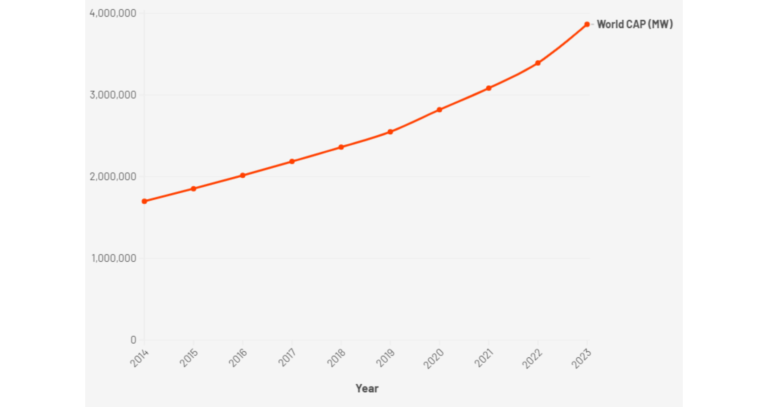

The problem is set to worsen. India’s electricity demand is expected to double to 2,325 TWh by 2030. At the same time, a growing share of renewable energy will increase variability. Derivatives offer a solution. They help participants lock in prices, manage exposure, and plan better.

Understanding how these two markets differ

Electricity trades in India happen under two separate structures: the physical delivery market regulated by the Central Electricity Regulatory Commission (CERC), and the financial derivatives market regulated by SEBI. The difference between them is significant:

These two frameworks operate independently. A 2021 Supreme Court ruling clarified the division: CERC will oversee physical trades, while SEBI regulates financial ones. This ensures grid stability is maintained even as financial markets develop around electricity.

How electricity futures and options work

Futures contracts allow participants to buy or sell electricity at a set price for a future date. These are traded on exchanges and are fully transparent. Unlike over-the-counter forward contracts, futures carry no counterparty risk.

NSE standardizes these contracts in 1 MWh units. The settlement is based on IEX’s Day-Ahead Market (DAM) price. Say a Discom expects spot prices to spike to Rs 4,000/MWh but has a PPA at Rs 3,500. By buying a futures contract at Rs 3,500, it can offset its losses when the spot market exceeds that amount. If spot prices drop below Rs 3,500, it loses on the futures side but gains from cheaper physical power.

Options work differently. They give the buyer the right, but not the obligation, to buy or sell at a certain price. They are like insurance.

For example, a Discom might buy a put option with a strike price of Rs 6.1 per unit. If the market price drops to Rs 4, the Discom gains from buying power cheaply, while the only loss is the premium paid. If the price rises, the put option kicks in and cushions the price shock.

MCX offers an example from the generator’s side. If a generator expects prices to fall from Rs 5 to Rs 3, it can buy a put option at Rs 3.5 for a Rs 0.25 premium. If the market drops to Rs 4, its net loss is smaller than it would have been without the option.

How to trade MCX electricity futures

To begin trading electricity derivatives on MCX, traders need a commodity trading account with a SEBI-registered broker. This process involves completing KYC formalities, linking a demat account, and registering a bank account for settlements. Several brokers offer this service, including Zerodha Commodities, ICICI Direct, Angel One, Motilal Oswal, and Sharekhan.

Trading requires margin money. MCX mandates an initial margin—typically 10–15% of the contract value—and a Mark-to-Market (MTM) margin that adjusts daily based on price movements. These can be paid in cash or approved securities. Exact requirements can vary across brokers and market conditions.

After completing the setup, trading happens via a broker’s terminal or mobile platform. Each contract is tagged with a symbol indicating delivery details—such as “ELECRRDEL240701” for a North Region (Delhi) contract delivering on July 1. Traders place buy or sell orders based on their price outlook, and track daily MTM changes as prices move.

Electricity futures on MCX are financially settled, not physically delivered. Each contract covers 1 megawatt hour (MWh), and the settlement price is based on the IEX Day-Ahead Market average for the specified delivery day. Contracts are offered with weekly, monthly, and quarterly tenors and expire three days before the delivery date.

On the expiry date, which falls three calendar days before delivery, trading stops and the contract moves into final settlement. For example, a contract delivering on July 10 will expire on July 7. Final settlement is purely financial, calculated using the IEX Market Clearing Price (MCP) for July 10. This buffer ensures that all payments and margins are cleared without interfering with physical power flows.

Participation in these contracts requires attention to several market signals—such as IEX price trends, regional demand patterns, weather forecasts, and regulatory bulletins from SEBI, MCX, and Grid India. Since the market is new, liquidity may be limited, and bid-ask spreads could be wide, requiring traders to evaluate entry and exit positions carefully.

Why derivatives matter for the economy

NSE outlines the key benefits. First, risk gets transferred. Discoms or generators can hedge their exposure, passing the risk to speculators or arbitrageurs willing to take it on.

Second, derivatives increase trading volumes. That benefits even the IEX cash market, as more participants engage and more price signals become visible.

Third, they improve price discovery. In India, where most power is sold through fixed PPAs, there is often little transparency about market expectations. Derivatives change that.

MCX adds more. With proper use, derivatives can reduce volatility and help optimize PPA costs. If exchange prices are lower than variable PPA components, Discoms may choose not to schedule those expensive contracts.

In fact, 85% of short-term power trading in India already happens via exchanges or traders. Adding derivatives only strengthens this trend.

Dealing with India’s structural problems

PPAs are inflexible. If demand drops unexpectedly—say, due to an early monsoon—Discoms still pay for contracted power. Derivatives let them adjust. They can sell futures or buy options to reflect real-time demand.

MCX also points out that India’s industrial consumers, who used 43% of power in 2019–20, face high tariffs. That is because they cross-subsidize residential users. For them, price stability matters. Derivatives offer a tool to manage these swings.

What lies ahead

The opportunities are clear. Discoms and generators can hedge better. Industrial buyers can stabilize costs. Financial investors get a new asset class.

But challenges remain. Spot market volatility can cause sudden losses. Low volumes may make trades expensive. And the regulatory environment could still evolve.

Still, the direction is promising. As electricity demand rises and renewables bring more uncertainty, derivatives become essential tools. They make the market smarter, safer, and more responsive.

The launches by NSE and MCX signal India’s entry into a more mature market structure. They align with the country’s long-term energy goals and support its vision of ‘Viksit Bharat’—a developed India. By improving risk management and market efficiency, electricity derivatives are reshaping the way power is traded and priced.

Featured photograph is for representation only.