Author: PPD Team Date: 24/02/2025

The Ministry of Power (MoP) has released the “13th Annual Integrated Rating & Ranking: Power Distribution Utilities” providing a detailed evaluation of the financial and operational performance of power distribution companies (DISCOMs) and power departments across India. The rating is conducted by Power Finance Corporation (PFC) on behalf of the ministry.

The utilities are assigned grades ranging from A+ to D. Out of 72 utilities, 63 were rated, with Jammu Power Distribution Corporation Limited (JPDCL), Kashmir Power Distribution Corporation Limited (KPDCL), Lakshadweep Power Department, and Chandigarh Power Department excluded due to unavailable audited accounts. Additionally, Torrent Power Surat, Torrent Power Ahmedabad, Torrent Power Dadra & Nagar Haveli and Daman & Diu Power Distribution Corporation Limited (DNHDD-PDCL), Tata Power Mumbai, and CESC did not participate in the exercise.

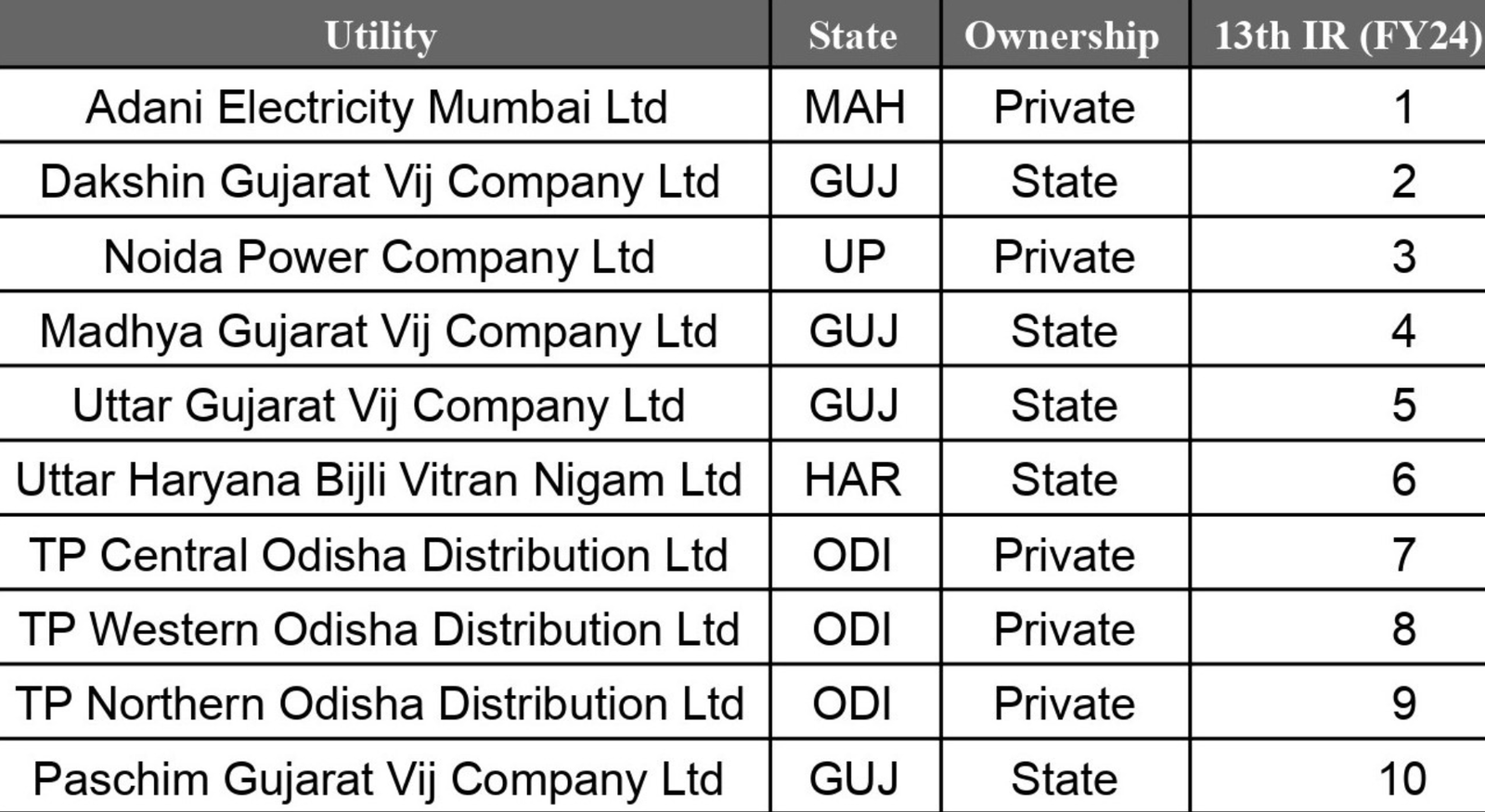

The results from the 13th rating exercise indicate an overall improvement compared to the previous year. The top ten utilities are shown in the table below:

Grades improved for 15 DISCOMs and six power departments, while 13 DISCOMs saw downgrades. Among the 63 rated utilities, 25 DISCOMs and nine power departments recorded a score increase of more than 5% from the previous year. The number of utilities rated C or lower (C-, D) decreased from 21 in FY23 to 18 in FY24.

Red card metrics were assigned to utilities with significant financial or operational concerns. Auditor’s adverse opinions were noted for Bangalore Electricity Supply Company Limited (BESCOM), Mangalore Electricity Supply Company Limited (MESCOM), Maharashtra State Electricity Distribution Company Limited (MSEDCL), and Telangana Northern Power Distribution Company Limited (TNPDCL). Himachal Pradesh State Electricity Board Limited (HPSEBL) was flagged for unavailability of audited accounts. No utilities were flagged for default to banks or financial institutions.

Grades were downgraded for Tata Power Delhi Distribution Limited (TPDDL), BSES Rajdhani Power Limited (BRPL), BSES Yamuna Power Limited (BYPL), Ajmer Vidyut Vitran Nigam Limited (AVVNL), and Jaipur Vidyut Vitran Nigam Limited (JVVNL) due to an increase in regulatory assets. Uttarakhand Power Corporation Limited (UPCL), TP Southern Odisha Distribution Limited (TPSODL), Purvanchal Vidyut Vitran Nigam Limited (PuVVNL), and Telangana Southern Power Distribution Company Limited (TGNPDCL) were downgraded due to overriding conditions related to the ACS-ARR gap.

Key Findings

- AT&C (Aggregate Technical & Commercial) Losses: Increased to 16.3% from 15.3%, primarily due to a 1.2 percentage point drop in collection efficiency. However, 40 utilities improved their AT&C losses.

- Billing Efficiency: Slight increase to 86.9%, though power departments recorded a decline. 14 utilities had efficiency below the scoring threshold.

- Collection Efficiency: Dropped by 1.2 percentage points to 96.4%. Four utilities recorded efficiency below the lower threshold, while 15 achieved 100%.

- Tariff Subsidy Realization: Declined to 97.4% from 108.6% in FY23.

- Days Receivable: Improved to 115 days from 118 days, with some DISCOMs improving by over 30 days while others saw deterioration.

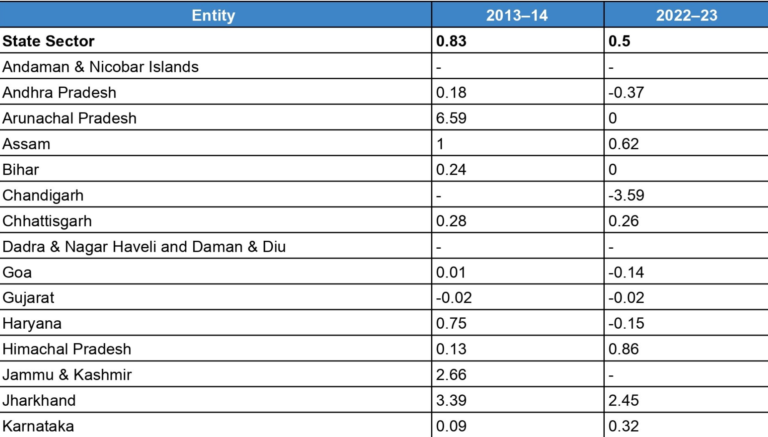

- ACS-ARR Gap: Improved by Rs 0.20 per kWh, reducing the absolute cash gap from Rs 830 billion in FY23 to Rs 580 billion in FY24. Some utilities saw significant improvement, while others faced widening financial gaps.

Regulatory compliance was inconsistent across states, with some delays and exceptions. Timely tariff orders for FY25 were issued in 13 states and Union Territories, while West Bengal (IPCL), Jammu & Kashmir, and Delhi DISCOMs did not issue orders. FY23 true-up orders were issued for 61 out of 72 utilities, with delays recorded in 39 cases. Automatic pass-through of fuel costs was implemented in 24 states, allowing DISCOMs to adjust tariffs based on power purchase costs. Substantial regulatory assets persisted in Tamil Nadu, Rajasthan, Kerala, and Delhi.

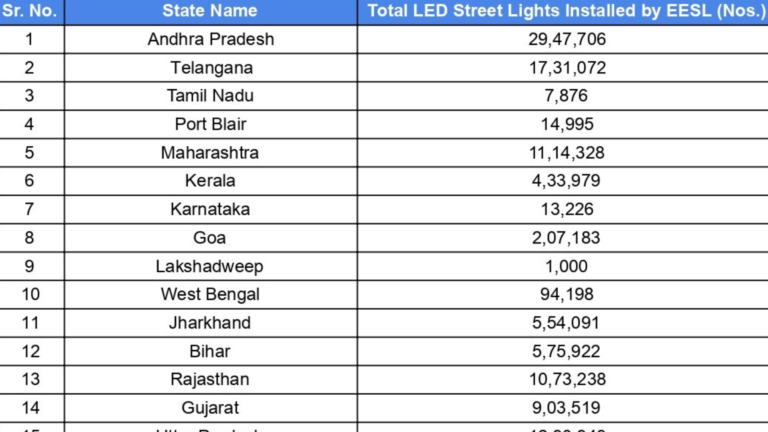

The report identifies best practices implemented by utilities to improve financial and operational efficiency. Digital payment adoption has increased, with multiple payment options, mobile apps, and automated customer engagement tools. AI-driven complaint resolution and multilingual billing systems enhance customer support. Smart metering, SCADA automation, and AI-based analytics optimize power distribution. Digital transformation initiatives such as enterprise resource planning (ERP) systems and cloud-based operations improve efficiency. Infrastructure modernization, underground cabling, and IoT-based grid monitoring enhance reliability. Workforce safety measures, including real-time AI-based monitoring and protective gear, ensure operational security. Renewable energy integration efforts focus on rooftop solar adoption and microgrid projects. Theft prevention mechanisms, AI-driven monitoring, and loss reduction strategies contribute to revenue protection. Social initiatives under corporate social responsibility (CSR) programs support education, skill development, and employment generation.

The findings from the 13th Integrated Rating Exercise provide valuable insights into the financial health and operational performance of India’s power distribution sector, aiding policymakers, regulators, and industry stakeholders in driving reforms and improving sustainability.

Read the full report here.