Transformation and transmission capacity overview for August 2024

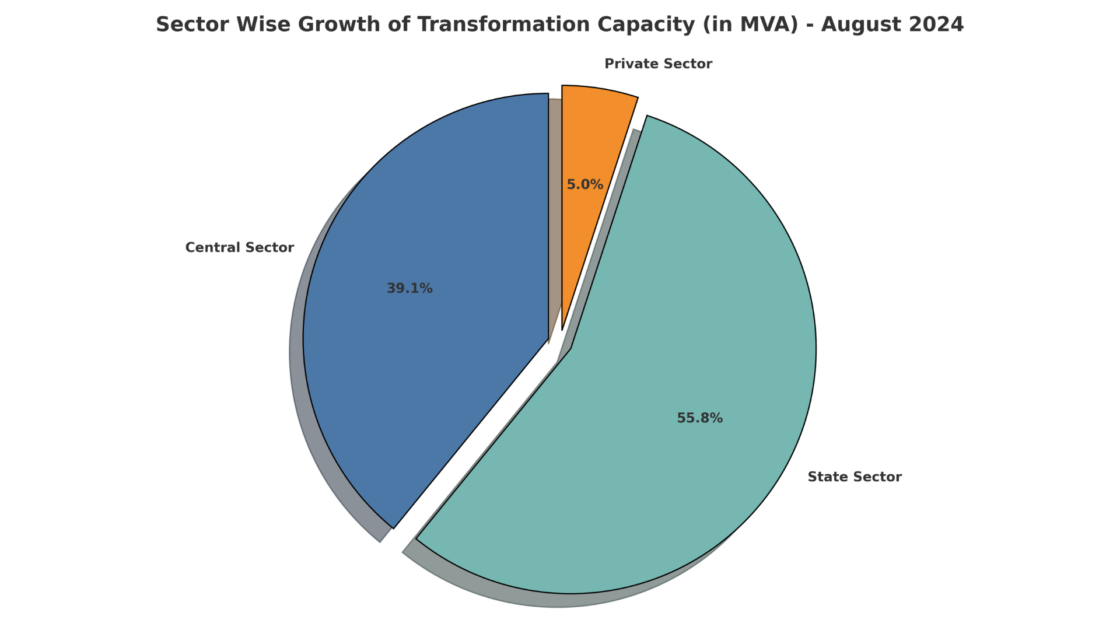

As of August 2024, the total transformation capacity in India reached 12,69,350 MVA. During the financial year 2024-25, up until August, a total of 18,270 MVA had been added to the country’s substations, with 3,650 MVA being added in August alone.

The Central Sector contributed 6,330 MVA out of the planned 51,645 MVA during the first five months of FY 2024-25. Power Grid Corporation India Limited (PGCIL) added 6,015 MVA during this period. The progress in the Central Sector falls short of the targets set for this fiscal year. State utilities added 11,940 MVA during the same period, slightly below the target for the period. States such as Uttar Pradesh and Tamil Nadu were leading contributors, adding 2,900 MVA and 1,950 MVA, respectively. The private sector has shown minimal progress, with no new capacity added during the period from April to August 2024, despite an ambitious target of 16,820 MVA. Key players like Adani, with a target of 6,000 MVA, and Megha Engineering, also targeting 6,000 MVA, failed to achieve any transformation capacity during this period.

When analyzing the voltage-wise growth, 400 kV substations contributed the largest share of capacity, with 297,700 MVA being added. This was followed by 220 kV substations, which added 464,738 MVA.

Looking at the historical context, India’s transformation capacity has expanded dramatically over the past few decades. From 466,621 MVA in the 6th Plan (1980-1985), the country’s capacity has grown to 1,269,350 MVA in 2024.

India’s total transmission line capacity at 220 kV and above reached 4,88,423 ckm as of August 2024. During FY 2024-25, 2,879 ckm of transmission lines were added, with 836 ckm added in August. The inter-regional transmission capacity in the country increased to 1,18,740 MW.

In the Central Sector, 457 ckm of transmission lines were added against a planned 5,413 ckm for FY 2024-25. The major contributor, pgcil, added 405 ckm, while DVC contributed 52 ckm during the period.

The State Sector added 2,422 ckm out of a planned 8,965 ckm for the fiscal year. Uttar Pradesh made the most significant contribution by adding 738 ckm out of its 1,247 ckm target. Telangana contributed 285 ckm out of its 1,183 ckm target, while Tamil Nadu and Punjab added 149 ckm and 125 ckm, respectively.

In contrast, the Private Sector did not contribute any transmission lines during FY 2024-25, despite setting a target of 2,289 ckm. Companies such as Adani and Sterlite failed to meet their respective targets of 636 ckm and 823 ckm.

In terms of voltage-wise growth, 400 kV transmission lines saw an addition of 55,202 ckm. Additionally, 230/220 kV lines added 2,04,787 ckm.

Historically, India’s transmission line capacity has expanded significantly, growing from 52,034 ckm in the 6th Plan (1980-85) to 4,88,423 ckm by August 2024. Notable growth periods include the 9th Plan (1997-2002), which saw an addition of 152,269 ckm, and the 11th Plan (2007-2012), during which 2,57,481 ckm were added to the grid.