Regulatory Developments in Power Distribution Sector: May 7, 2025

Author: PPD Team Date: May 7, 2025

TGERC approves additional surcharge for open access consumers in FY 2025-26

The Telangana Electricity Regulatory Commission (TGERC) has approved an additional surcharge (AS) of Rs 1.45 per kWh for open access (OA) consumers for the first half of FY 2025-26 (April to September).

The Federation of Telangana Chambers of Commerce and Industry (FTCCI) contested the proposed AS of Rs 1.69/kWh, deeming it excessive. However, Telangana Discoms (TGDISCOMs) defended the surcharge, arguing that it was necessary to recover fixed costs from long-term power purchase agreements.

TGERC upheld the exemption for GEOA consumers who are paying fixed or demand charges. It rejected the claim that registration on the Green Energy Open Access Registry (GOAR) portal was mandatory but maintained that stranded capacity calculations should include contributions from GEOA and captive power plants (CPPs).

TGERC revised the stranded capacity to 54.82 MW and fixed charges to Rs 5,686.80 crore, resulting in a slightly lower AS of Rs 1.51/kWh. In an effort to balance stakeholder interests, the Commission capped the surcharge at Rs 1.45/kWh, which aligns with 20% of the average cost of supply.

Read the full order here.

DERC allows 10.47% PPAC levy for TPDDL for May–July 2025

The Delhi Electricity Regulatory Commission (DERC) has approved a 10.47% Power Purchase Adjustment Cost (PPAC) for Tata Power Delhi Distribution Ltd (TPDDL) for the period from 1 May 2025 to 31 July 2025. This relates to power purchase costs incurred during Q3 FY 2024–25 (October to December 2024).

TPDDL had sought permission to recover a 14.17% PPAC, citing a total power purchase cost of 14.42% for Q3, adjusted for previously approved and suo motu levied charges. However, the Commission allowed only 10.72%, excluding costs beyond the defined scope under Regulation 134 of DERC Tariff Regulations, 2017 and Regulation 30 of the Business Plan Regulations, 2023. After adjustments, the final approved PPAC stood at 10.47%.

This PPAC will replace the current rate of 12.89%, which ended on 30 April 2025. The Commission stated that any surplus or deficit would be addressed during the true-up process with carrying cost, subject to a prudence check.

Petition No. 23/2025 | Read the full order here.

JSERC approves lower ARR and tariff for JBVNL

The Jharkhand State Electricity Regulatory Commission (JSERC) has approved the truing-up for FY 2023–24, annual performance review for FY 2024–25, and the aggregate revenue requirement (ARR) and tariff for FY 2025–26 for Jharkhand Bijli Vitran Nigam Limited (JBVNL). The order significantly reduces JBVNL’s projected expenses and reverses a claimed revenue deficit.

The Commission approved a total power purchase expense of Rs 7,507.45 crore for FY 2025–26, down from JBVNL’s petitioned Rs 8,808.18 crore. This includes a disallowance of Rs 1,022.22 crore for excess distribution losses. Intra-state transmission charges were added at Rs 575.32 crore. Interstate transmission charges were reduced to Rs 393.48 crore.

Operations and maintenance expenses were approved at Rs 779.54 crore. Of this, employee expenses of Rs 280.33 crore were allowed, but terminal liabilities of Rs 86.31 crore were disallowed. Administration and general expenses were capped at Rs 127.45 crore. Depreciation was revised to Rs 403.77 crore and return on equity to Rs 400.55 crore. Interest on long-term loans was approved at Rs 375.06 crore, and interest on consumer security deposits was cut to Rs 25.78 crore. Interest on working capital loans was disallowed entirely.

The Commission revised non-tariff income to Rs 511.64 crore. After adjustments, the approved ARR stood at Rs 8,980.52 crore. At the revised tariff, JSERC projected revenue of Rs 10,322.49 crore, resulting in a surplus of Rs 1,341.97 crore. This contrasts with JBVNL’s projected deficit of Rs 1,742.77 crore.

Approved ARR summary for FY 2025–26 (Rs crore)

Read the full order here.

KSERC approves Rs 1,308.32 lakh surplus for KPUPL in FY 2023–24 truing-up

The Kerala State Electricity Regulatory Commission (KSERC) has issued its truing-up order for KINESCO Power and Utilities Private Limited (KPUPL) for the financial year 2023–24. KPUPL had sought approval for power purchase costs, operational expenses, capital expenditures, and tax-related claims.

KSERC approved a revenue surplus of Rs 1,308.32 lakh, with several downward revisions. The Commission disallowed Rs 69.14 lakh due to distribution losses exceeding the 1.73% norm, as KPUPL recorded 2.66%. Operational and maintenance (O&M) expenses were limited to Rs 233.06 lakh. Against KPUPL’s return on equity claim of Rs 45.64 lakh, only Rs 4.43 lakh was approved. A claim of Rs 11.05 lakh for corporate social responsibility (CSR) spending was rejected, as such costs cannot be passed on to consumers.

Power purchase cost was a key area of dispute. KSERC approved Rs 7,241.05 lakh, adjusting for excess losses and resolving discrepancies with Kerala State Electricity Board (KSEB) records. KSEB also objected to the inclusion of electricity duty under Section 3 of the Kerala Electricity Duty Act.

KPUPL has been directed to file a separate petition for capital investment proposals, with prior approval required for any asset creation. The Commission clarified that green tariff charges levied by KSEB on KPUPL are inadmissible under the power purchase agreement.

Approved figures include Rs 68.22 lakh in employee costs and Rs 65.94 lakh in depreciation. The cumulative revenue surplus up to FY 2023–24 stands at Rs 8,911.71 lakh, which KPUPL must retain in a separate fund.

Petition No: OP 03/2025 | Read the full order here.

KSERC approves Rs 5.18 crore investment by Technopark for power upgrades and solar plants

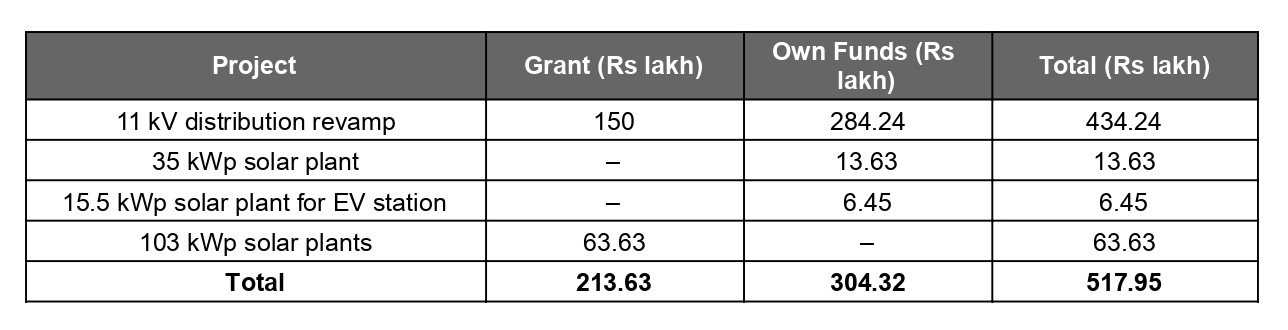

The Kerala State Electricity Regulatory Commission (KSERC) has provisionally approved a Rs 5.18 crore capital investment plan by Technopark, Trivandrum. The order, issued on 23 April 2025, covers system upgrades and solar installations aimed at improving reliability and meeting statutory power supply norms.

The largest allocation, Rs 4.34 crore, is for revamping the 11 kV distribution network in Technopark Phase I. This includes replacing old cables, adding feeders, and installing Ring Main Units (RMUs) with SCADA monitoring. The upgrade will help meet the “n-1” contingency standard. Funding includes a 35% government grant (Rs 1.50 crore) and 65% from Technopark’s internal funds.

KSERC also approved three solar projects: a 35 kWp rooftop system (Rs 13.63 lakh), a 15.5 kWp plant for an EV charging station (Rs 6.45 lakh), and a 103 kWp installation at Park Centre and Pump House (Rs 63.63 lakh). The Commission mandated use of MNRE benchmark rates and existing government grants.

Capital Investment Breakdown:

Petition No: OP 83/2023 | Read the full order here.

MSERC approves revised ARR and tariffs for MePDCL for FY 2025-26

The Meghalaya State Electricity Regulatory Commission (MSERC) has approved the revised Aggregate Revenue Requirement (ARR) and distribution tariff for Meghalaya Power Distribution Corporation Limited (MePDCL) for FY 2025-26. The approved ARR is Rs 1,665.12 crore, reduced from MePDCL’s projected figures after reviewing power purchase expenses, depreciation, and return on equity.

Power purchase cost, including transmission charges, has been approved at Rs 1,666.75 crore. The Commission followed merit-order dispatch while determining these costs. MePDCL had initially reported a revenue gap of Rs 509.71 crore, citing increased procurement and operational costs. MSERC narrowed this gap through cost rationalisation.

The average cost of supply for FY 2025-26 is Rs 8.48 per unit. To ensure compliance with the National Tariff Policy, MSERC revised tariffs across consumer categories while keeping cross-subsidies within ±20 per cent of the average cost. Ferro Alloy industries were exempted from cross-subsidy surcharges due to their lower applicable tariff.

Wheeling charges for open access consumers have been set at Rs 1.96 per kWh, and cross-subsidy surcharges at Rs 2.03 per kWh. The Commission also introduced additional surcharges to recover fixed costs, particularly from open-access users during off-peak hours.

Renewable Purchase Obligations (RPO) have been fixed at 33.01 per cent. MePDCL is required to procure 1,859.21 million units from renewable sources during FY 2025-26. MSERC has directed the utility to comply with its Resource Adequacy Guidelines and submit periodic compliance reports.

For consumer categories, the revised average tariff is Rs 6.95 per kWh for domestic low-tension users, Rs 10.17 per kWh for high-tension commercial users, and Rs 10.15 per kWh for extra high-tension industrial users. Ferro Alloy industries will continue at Rs 6.95 per kWh.

Petition No: Case No. 09 of 2024 | Read the full order here.

UPERC notifies Multi-Year Tariff (Distribution) Regulations, 2025

The Uttar Pradesh Electricity Regulatory Commission (UPERC) has announced the Multi-Year Tariff (Distribution) Regulations, 2025, effective from April 1, 2025, to March 31, 2030.

Under the new regulations, licensees will be required to submit annual filings for True-Up, Annual Performance Review (APR), and Aggregate Revenue Requirement (ARR) petitions by November 30 each year. The ARR will cover power purchase costs, transmission charges, O&M expenses, depreciation, and return on equity.

In terms of power procurement, licensees need to align their plans with Merit Order Despatch (MOD) principles, with renewable energy purchases being excluded up to the Renewable Purchase Obligation (RPO) limits. Consumers will also have the option to choose 100% renewable energy supply, which will cover average purchase costs, cross-subsidy charges, and service fees.

The regulations also introduce the Fuel and Power Purchase Adjustment Surcharge (FPPAS), which allows for monthly billing adjustments for fuel and transmission cost variations. This adjustment is capped at ±10% of the approved rate, with calculations based on a formula that compares actual versus approved power purchase costs and inter-state transmission charges.

Regarding financial prudence, the regulations set a fixed debt-equity ratio of 70:30 for new projects and revise depreciation rates for assets capitalized after March 31, 2025. Additionally, return on equity is fixed at 15% post-tax, grossed up for tax adjustments.

Licensees will also be required to adhere to approved AT&C (Aggregate Technical and Commercial) loss reduction targets. Open access consumers will face cross-subsidy surcharges, capped at 20% of the average supply cost, along with additional surcharges for stranded costs, which will be phased out over four years.

Metering requirements have been revised, with a 100% metering mandate for employees (LMV-10 category) to be completed by March 31, 2025. If this is not met, billing will be based on double the average consumption of metered urban consumers.

The regulations also focus on financial and operational accountability. O&M expenses are segregated into employee costs (60% for distribution, 40% for retail supply), R&M (90% for distribution), and administrative costs (60% for retail supply). For capital investment plans, projects exceeding ₹5 crore (for licensees in three or more districts) or ₹7.5 crore (for smaller licensees) require prior approval.

Additionally, the regulations mandate the disclosure of tariff petitions and public hearings before approval, ensuring greater transparency. Licensees are also required to publish FPPAS calculations and approved tariffs on their websites.

The new MYT regulations seek to strike a balance between consumer affordability and licensee viability, while also promoting renewable energy integration and operational efficiency.

Read the full order here.

UPERC approves Rs 62.31 crore plan for five new substations in Greater Noida

The Uttar Pradesh Electricity Regulatory Commission (UPERC) has approved Noida Power Company Limited’s (NPCL) proposal to build five 33/11 kV substations in Greater Noida. The project involves a capital expenditure of Rs 62.31 crore and is intended to meet future load growth and rising demand in the region.

A key issue in the petition was the cost of civil works. NPCL initially estimated Rs 17.35 crore, which was later revised to Rs 13.08 crore following soil investigations and structural assessments. The Central Electricity Authority (CEA) further vetted this cost at Rs 11.98 crore, noting a 2.25% variation from NPCL’s revised figure.

CEA also reviewed the specifications of power transformers and suggested technical optimizations to reduce costs while ensuring safety. NPCL accepted the changes, including lowering flux density and temperature rise limits. UPERC approved additional safety features costing Rs 8.52 lakh per transformer.

On equipment pricing, the Commission found NPCL’s cost estimates for GIS (Gas Insulated Switchgear) and AIS (Air Insulated Switchgear) panels in line with those of other utilities such as KESCO and PVVNL. However, it stressed the need for standardized equipment capacities in future projects.

UPERC rejected NPCL’s request for pre-approved operation and maintenance (O&M) expenses, including 2.71% for employee costs, 1.39% for administration and general expenses, and 2.73% for repairs and maintenance. It directed NPCL to manage these internally as per existing regulations.

UPERC instructed NPCL to conduct soil testing before filing future petitions, maintain a standard cost sheet for capital items, and adopt uniform equipment specifications.

Petition No: 2089 of 2024 | Read the full order here.

TNERC approves TNPDCL true-up for FY24, notes Rs 6,922 crore revenue gap

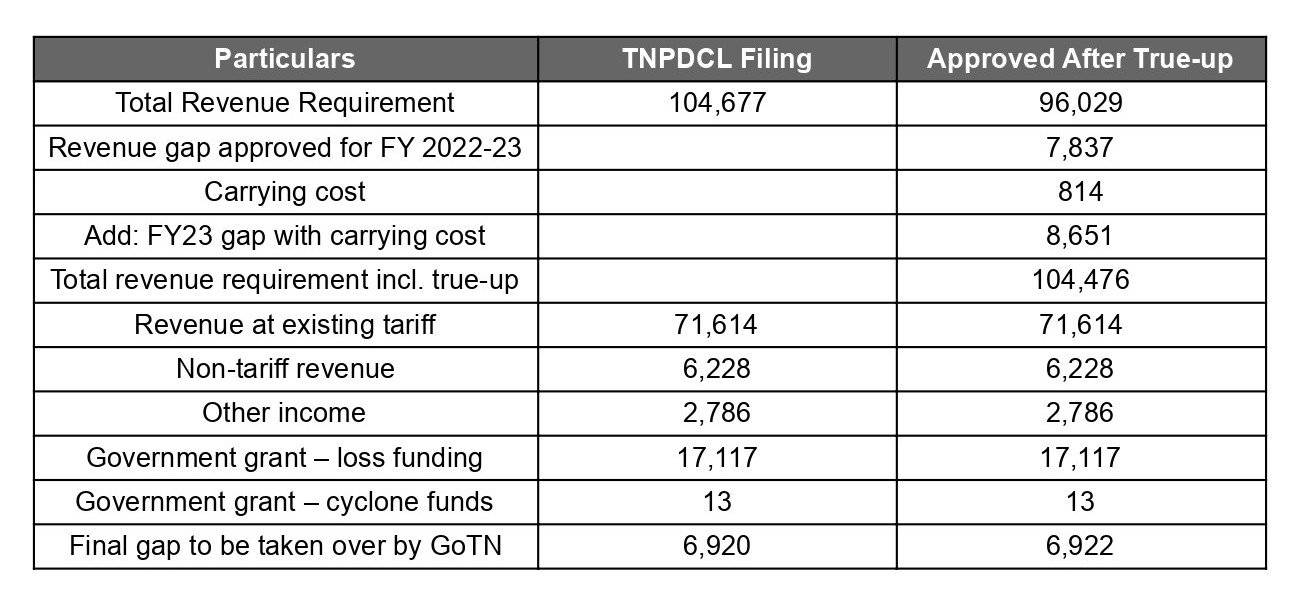

The Tamil Nadu Electricity Regulatory Commission (TNERC) has issued its final true-up order for Tamil Nadu Power Distribution Corporation Limited (TNPDCL) for FY 2023-24. The order, dated April 30, 2025, finalises key financial metrics, including power purchase costs, energy sales, and cumulative revenue gap.

Approved energy sales stood at 93,379.85 million units (MU), with distribution losses at 10.41%. The Commission flagged an increase in losses over the previous year and directed TNPDCL to provide detailed, voltage-wise loss and injection data from FY 2024-25 onward.

The aggregate revenue requirement (ARR) for FY 2023-24 was set at Rs 96,029 crore. Power purchase costs accounted for Rs 48,130 crore. The Commission urged TNPDCL to optimise procurement by shifting peak demand to solar hours and advancing renewable energy projects.

The Commission approved a revenue gap of Rs 6,922 crore for FY 2023-24, factoring in government subsidies and grants. The Tamil Nadu government had earlier committed to covering 90% of TNPDCL’s total losses for FY 2023-24, amounting to Rs 16,077 crore. For FY 2022-23, a deficit of Rs 7,837 crore was approved, with Rs 814 crore in carrying cost. TNPDCL was directed to recover these amounts through state support, in line with the Electricity (Amendment) Rules, 2024.

Other directives included creating corpus funds for employee benefits, enhancing agricultural consumption estimates, and complying with energy audit norms. TNPDCL was also instructed to accelerate pumped storage and solar feeder development.

Cumulative revenue gap after true-up till FY 2023-24 (Rs crore)

Petition No: M.P. No. 18 of 2025 | Read the full order here.

TGERC approves Rs 658.49 billion ARR for Telangana discoms for FY26

The Telangana Electricity Regulatory Commission (TGERC) has approved an Aggregate Revenue Requirement (ARR) of Rs 658.49 billion for FY 2025-26. The order, issued on April 29, 2025, covers the state’s two power distribution companies—Southern Power Distribution Company of Telangana (TGSPDCL) and Northern Power Distribution Company of Telangana (TGNPDCL).

TGSPDCL’s approved ARR stands at Rs 460.35 billion, while TGNPDCL’s ARR is set at Rs 198.14 billion. The major cost component for both utilities is power procurement, accounting for 79% of TGSPDCL’s ARR and 71% of TGNPDCL’s. TGSPDCL will spend Rs 365.30 billion on power purchases, while TGNPDCL’s outlay is Rs 140.42 billion. These costs include allocations from Telangana State Power Generation Corporation (TGGENCO), central sector stations, and renewable energy sources.

Despite the rise in expenses, TGERC has retained the existing retail supply tariffs across all consumer categories, including domestic, industrial, and agricultural segments.

Distribution losses are capped at 8.08% for TGSPDCL and 8.93% for TGNPDCL. These targets are marginally lower than in previous years, driven by feeder-level audits and network upgrades.

The Cross-Subsidy Surcharge (CSS) varies across consumer types. Industrial consumers under HT-I (11 kV) face a surcharge of up to Rs 1.83 per unit, while agricultural users remain exempt.

ARR approved by TGERC for FY 2025-26 (Rs crore)

Petition No: O.P. No. 21 of 2025 and I.A. No. 04 of 2025 & O.P. No. 22 of 2025 and I.A. No. 05 of 2025 | Read the full order here.

TGERC finalises APR, 4th Control Period review, and wheeling tariffs

The Telangana Electricity Regulatory Commission (TGERC) has issued its final order on the Annual Performance Review (APR) for FY 2023-24, the End of Control Period Review for the 4th Control Period (FY 2019-20 to FY 2023-24), and the revised Aggregate Revenue Requirement (ARR) and wheeling tariffs for FY 2025-26. The order follows petitions by the Southern Power Distribution Company of Telangana Limited (TGSPDCL) and the Northern Power Distribution Company of Telangana Limited (TGNPDCL).

Key issues included shortfalls in capital expenditure, deviations in Operation and Maintenance (O&M) costs, and compensation disputes for electrical accidents. TGSPDCL reported a capital expenditure gap of Rs. 806.82 crore, while TGNPDCL’s shortfall was Rs. 1,381 crore.

The Commission approved a net revenue surplus of Rs. 94.91 crore for TGSPDCL and Rs. 742.18 crore for TGNPDCL for the 4th Control Period. It directed these surpluses to be passed on to consumers in FY 2025-26. Revised wheeling charges for FY 2025-26 were also approved. For 33 kV long-term access, TGSPDCL’s tariff is set at Rs. 53.20/kVA/month and Rs. 0.0739/kVA/hr for short-term. TGNPDCL’s approved rates are Rs. 51.20/kVA/month and Rs. 0.0711/kVA/hr.

The Commission also ruled on other voltage levels as follows:

For 11 kV, TGSPDCL and TGNPDCL tariffs are Rs. 215.19/kVA/month and Rs. 372.00/kVA/month, respectively.

For LT level, the approved tariffs are Rs. 705.06/kVA/month for TGSPDCL and Rs. 1107.86/kVA/month for TGNPDCL.

The Commission disallowed claims for ex-gratia compensation related to electrical accidents, citing inadequate justification. It also deferred TGSPDCL’s proposed Rs. 50 crore investment in smart meters, pending state government approval.

Petition No: OP No.1 of 2025, O.P.No. 3 of 2025 and O.P.No.31 of2024. (TGSPDCL) O.P. No.2 of 2025, O.P.No.4 of 2025 and O.P.No.32 of 2024. (TGNPDCL) | Read the full order here.

TGERC approves revised ARR for CESS Sircilla with Rs 377 crore subsidy gap

The Telangana Electricity Regulatory Commission (TGERC) has approved the revised Aggregate Revenue Requirement (ARR) and Expected Revenue from Charges (ERC) for The Co-operative Electric Supply Society Limited (CESS), Sircilla, for FY 2025–26. The order, dated 29 April 2025, addresses financial adjustments and stakeholder inputs.

CESS had sought an ARR of Rs 654.65 crore, including Rs 572.31 crore for power purchase, Rs 59.07 crore for operation and maintenance (O&M), and Rs 9.95 crore as return on equity. After review, the Commission approved an ARR of Rs 581.38 crore. Adjustments were made to projections for power purchase, O&M, and depreciation. A revenue gap of Rs 377.37 crore was identified, to be fully subsidised by the state government.

During the public hearing, stakeholders raised concerns about the adequacy of subsidies for cottage industries using up to 10 HP, transparency in agricultural electricity charges, and the need for improved electrical safety. The Commission recommended raising the subsidy for small power loom units from 50% to 75%, subject to government approval.

Petition No: O.P. No. 27 of 2025 | Read the full order here.

For more regulatory updates, read the latest orders covered on Power Peak Digest: Energy Regulatory Updates – Power Peak Digest

Featured photograph is for representation only.