Author: PPD Team Date: 21/04/2025

UGVCL reports surplus in FY 2023–24, GERC approves ARR and tariff through FY 2029–30

The Gujarat Electricity Regulatory Commission (GERC) has issued its final order on Case No. 2421 of 2024, approving the truing up of FY 2023–24 and the Aggregate Revenue Requirement (ARR) and tariff for Uttar Gujarat Vij Company Limited (UGVCL) for the Multi-Year Tariff (MYT) control period from FY 2025–26 to FY 2029–30.

For FY 2023–24, UGVCL reported a total ARR of Rs 18,586 crore, exceeding the approved Rs 17,160 crore. Despite a Rs 1,426 crore increase in expenses, a revenue surplus of Rs 719 crore was reported due to higher-than-estimated revenue from power sales (Rs 18,997 crore) and other income, including subsidy. Losses of Rs 1,154 crore were attributed to uncontrollable factors such as taxes and power purchase, while Rs 289 crore in losses were under controllable factors like employee and R&M expenses.

GERC accepted UGVCL’s gain-loss accounting and approved net adjustments accordingly. Of the controllable gains, only one-third will be considered for pass-through.

For FY 2025–26, GERC approved an ARR of Rs 20,241 crore. Projected ARR for the MYT period increases to Rs 24,436 crore by FY 2029–30. The cost of power purchase accounts for over 85% of total expenditure. Employee, administrative, and R&M expenses also rise steadily. Return on equity remains at 15%, and return on capital employed is recognised additionally from FY 2026–27 onwards.

Key proposals approved for FY 2025–26 include new Time-of-Use (ToU) tariffs, rebates for 33 kV consumers, separate tariffs for smart pre-paid meter users under RDSS, and revised wheeling and cross-subsidy charges. Approved power purchase cost for FY 2025–26 is Rs 17,545 crore. The approved revenue for FY 2025–26 is Rs 20,688 crore, resulting in a surplus of Rs 446 crore.

The Commission noted objections from several stakeholders, including industry and consumer groups, regarding high employee costs, feeder losses, and arrears. UGVCL has been directed to improve collection efficiency, reduce distribution losses, and meet Renewable Purchase Obligation (RPO) targets during the control period.

Petition No: Case No. 2421/2024 | Read the full order here.

DGVCL reports Rs 495 crore surplus in FY 2023–24, GERC approves tariff through FY 2029–30

The Gujarat Electricity Regulatory Commission (GERC) has approved the truing up of expenses for FY 2023–24 and issued the tariff order for Dakshin Gujarat Vij Company Limited (DGVCL) for the Multi-Year Tariff (MYT) control period FY 2025–26 to FY 2029–30.

For FY 2023–24, DGVCL reported an actual Aggregate Revenue Requirement (ARR) of Rs 23,030 crore, exceeding the approved Rs 20,876 crore by Rs 2,154 crore. Despite this, the Commission found a net revenue surplus of Rs 495 crore after adjustments for higher revenue and subsidy inflow.

Significant cost increases included power purchase expenses, which were Rs 1,205 crore above projections, and taxes, which rose sharply to Rs 961 crore from the approved Rs 19 crore. Gains from controllable factors such as O&M and capitalisation partially offset these.

GERC recognised losses of Rs 2,673 crore under uncontrollable factors and Rs 100 crore under controllable ones. Rs 33 crore of the controllable loss and the entire uncontrollable loss are allowed as pass-through in the next year’s tariff.

For FY 2025–26, the Commission approved a revised ARR of Rs 26,412 crore, including power purchase costs of Rs 20,879 crore. The estimated revenue at existing tariffs is Rs 26,617 crore, resulting in a projected surplus of Rs 205 crore. Surpluses rise further through FY 2029–30.

New tariff proposals include revised cross-subsidy surcharges, time-of-use tariffs, and incentives for prepaid smart meter users under the RDSS scheme. GERC also approved DGVCL’s capital expenditure and O&M projections, subject to efficiency improvements and compliance with regulatory directives.

The order notes objections from industry associations and consumer groups on tariff design, rising arrears, and unmet renewable targets. DGVCL is directed to address these issues and improve distribution efficiency.

Petition No: Case No. 2422/2024 | Read the full order here.

GERC approves tariff and revenue plans for PGVCL through FY 2029-30

The Gujarat Electricity Regulatory Commission (GERC) has issued its final order on the petition filed by Paschim Gujarat Vij Company Limited (PGVCL) concerning the truing-up of accounts for FY 2023-24, and the approval of its Aggregate Revenue Requirement (ARR) and tariff for FY 2025-26 under the Multi-Year Tariff (MYT) framework for the 4th Control Period (FY 2025-26 to FY 2029-30).

PGVCL reported an actual ARR of Rs 26,089.35 crore for FY 2023-24, exceeding the approved Rs 22,175.66 crore by Rs 3,913.69 crore. The rise was mainly due to a Rs 3,165.23 crore increase in power purchase costs and a significant jump in operation and maintenance (O&M) expenses, including a near doubling of repair and maintenance costs. However, after accounting for gains/losses and consumer subsidies, the utility posted a revenue surplus of Rs 493.22 crore for FY 2023-24.

For FY 2025-26, PGVCL’s ARR has been approved at Rs 25,947.40 crore, with projected revenue of Rs 25,969.53 crore, resulting in a marginal surplus of Rs 22.13 crore. The Commission has also approved capital expenditure plans, revised power purchase costs, and O&M projections for the entire control period.

The Commission noted stakeholder objections during the public hearing process, including those from industry associations and consumer groups, primarily concerning rising costs and service reliability. Responses from PGVCL were reviewed and addressed in the order.

The order also includes directives for PGVCL to improve distribution efficiency and reduce losses, along with approved wheeling charges, fuel surcharges, and green tariff provisions.

The order, issued on March 31, 2025, is expected to provide financial clarity and tariff stability for PGVCL over the next five years, with regular performance reviews and adjustments per regulatory guidelines.

Petition No: Case No. 2424/2024 | Read the full order here.

GERC clears MYT plan and tariff for Torrent Power Distribution in Surat for FY 2025-30

On March 29, 2025, the Gujarat Electricity Regulatory Commission (GERC) approved Torrent Power Limited – Distribution (Surat) [TPL-D(S)]’s Multi-Year Tariff (MYT) plan and tariff proposal for FY 2025-26, along with the truing-up of expenses for FY 2023-24. The order sets the regulatory framework for TPL-D(S)’s operations from FY 2025-26 to FY 2029-30.

For FY 2023-24, TPL-D(S) reported an actual Aggregate Revenue Requirement (ARR) of Rs 3,433.72 crore, substantially higher than the approved Rs 2,460.61 crore. The increase was mainly driven by power purchase costs, which surged to Rs 3,028.71 crore—Rs 980.61 crore more than approved. The trued-up revenue gap for the year stood at Rs 82.82 crore.

For FY 2025-26, the Commission approved an ARR of Rs 3,349.71 crore. With projected revenue of Rs 3,384.64 crore (including revised Fuel and Power Purchase Price Adjustment charges), the utility is expected to record a surplus of Rs 34.93 crore. However, after factoring in the FY 2023-24 deficit and carrying cost, a cumulative gap of Rs 82.11 crore remains to be recovered via tariff.

Key assumptions for the control period include sales growth influenced by lab-grown diamond industries and rooftop solar installations, stable O&M projections, and procurement from a mix of Torrent’s own generation, SUGEN/UNOSUGEN plants, renewable energy, and market sources. Capital expenditure plans cover EHV, HT/LT network upgrades, smart metering, and IT infrastructure.

Stakeholders, including consumer bodies and civic associations, raised objections regarding high power purchase costs, classification of certain consumers, and service quality. TPL-D(S) and the Commission addressed these concerns during a public hearing held on February 24, 2025.

Petition No: Case No. 2427 of 2024 | Read the full order here.

GERC approves MYT tariff and ARR for Torrent Power Dahej distribution till FY 2029-30

The Gujarat Electricity Regulatory Commission (GERC) has approved Torrent Power Limited – Distribution (Dahej) [TPL-D(D)]’s Multi-Year Tariff (MYT) plan and tariff proposal for FY 2025-26, alongside the truing-up of accounts for FY 2023-24. The final order, issued on March 29, 2025, covers the control period from FY 2025-26 to FY 2029-30 and sets the financial and operational framework for Torrent Power’s operations in the Dahej SEZ.

For FY 2023-24, TPL-D(D) reported an actual Aggregate Revenue Requirement (ARR) of Rs 566.46 crore, significantly higher than the approved Rs 370.01 crore. The rise was driven primarily by power purchase costs, which increased by Rs 189.48 crore over the approved amount. Despite the higher costs, the utility recorded a surplus of Rs 7.74 crore due to higher-than-expected energy sales of 794.67 MU against the approved 711.31 MU.

The Commission approved the trued-up ARR and acknowledged that the variation was largely due to uncontrollable factors such as increased industrial activity in the SEZ. Distribution losses were recorded at a low 0.38%, below the approved 0.45%.

For FY 2025-26, the approved ARR is Rs 585.74 crore, while expected revenue is Rs 567.41 crore, resulting in a projected revenue gap of Rs 18.33 crore. After accounting for the FY 2023-24 surplus and carrying cost, the net cumulative gap stands at Rs 9.45 crore, which TPL-D(D) has been allowed to recover through a tariff revision effective from April 1, 2025.

No objections were received from stakeholders during the public hearing process, held on February 24, 2025.

The order also includes approval of capital investments for network upgrades, smart metering, and IT systems, alongside wheeling charges and revised Fuel and Power Purchase Price Adjustment (FPPPA) mechanisms. This regulatory clarity is expected to support reliable power distribution in the Dahej SEZ over the next five years.

Petition No: Case No. 2428 of 2024 | Read the full order here.

GERC approves tariff and MYT plan for GIFT Power Company through FY 2029-30

The Gujarat Electricity Regulatory Commission (GERC) has issued its final order on the truing-up of accounts for FY 2023-24 and approval of the Aggregate Revenue Requirement (ARR) and tariff for FY 2025-26 to FY 2029-30 for GIFT Power Company Limited (GIFT PCL), the distribution licensee serving the GIFT City area in Gandhinagar.

For FY 2023-24, the Commission approved a trued-up ARR of Rs 46.41 crore, up from the originally approved Rs 37.64 crore. The increase was mainly due to higher operation and maintenance expenses, depreciation, and return on equity. GIFT PCL reported total energy sales of 44.37 million units (MU), lower than the approved 55.01 MU, with distribution losses at 2.60%—better than the approved 3.00%. The power purchase cost was approved at Rs 27.67 crore, translating to an average cost of Rs 6.10 per unit. The year closed with a revenue gap of Rs 7.71 crore.

For FY 2025-26, the Commission approved an ARR of Rs 76.08 crore and projected revenue of Rs 70.76 crore, resulting in a standalone revenue gap of Rs 5.32 crore. Over the MYT control period, the ARR is expected to grow steadily, reaching Rs 161.70 crore in FY 2029-30. Major cost components include power purchase expenses (projected to rise from Rs 47.41 crore in FY 2025-26 to Rs 118.25 crore in FY 2029-30) and capital expenditure linked to infrastructure development.

No objections were received during the public hearing held on February 24, 2025. The Commission also approved GIFT PCL’s requests on wheeling charges, Fuel and Power Purchase Price Adjustment (FPPPA) applicability, and cross-subsidy surcharge.

Issued on March 31, 2025, the order provides regulatory clarity for GIFT PCL’s operations over the next five years, ensuring a framework for tariff stability and infrastructure expansion within the GIFT City area.

Petition No: Case No. 2431 of 2024 | Read the full order here.

GERC approves MGVCL tariff and ARR for FY 2025-26; clears FY 2023-24 accounts

The Gujarat Electricity Regulatory Commission (GERC) has issued its final tariff order for Madhya Gujarat Vij Company Limited (MGVCL), covering the truing up of accounts for FY 2023-24 and the approval of Aggregate Revenue Requirement (ARR) and retail supply tariff for FY 2025-26. This also marks the start of the fourth Multi-Year Tariff (MYT) control period, spanning from FY 2025-26 to FY 2029-30.

The petition, filed by MGVCL on November 30, 2024, was admitted as Case No. 2423/2024.

During the truing up for FY 2023-24, the Commission noted a slight increase in actual ARR compared to the approved figures, primarily due to higher tax payments and employee costs. However, lower power purchase costs provided relief. The Commission approved a net revenue surplus of Rs 26.61 crore for FY 2023-24.

For FY 2025-26, the approved ARR stands at Rs 10,585.10 crore against an expected revenue of Rs 10,611.71 crore, leading to a similar revenue surplus of Rs 26.61 crore. As a result, no hike in the base tariff has been ordered. The Commission has instead introduced several structural changes to encourage efficiency and demand-side management. These include time-of-use (ToU) discounts for consumption during off-peak hours, the extension of ToU charges to electric vehicle users under LT and HT categories, and the introduction of a dedicated tariff category for smart pre-paid meter consumers under the RDSS scheme. Rebates for consumers drawing power at 33 kV and above have also been enhanced.

The order also includes updated wheeling charges and cross-subsidy surcharges, applicable from April 1, 2025, and provides detailed guidelines on the Fuel and Power Purchase Price Adjustment Surcharge (FPPAS).

Petition No: Case No. 2423/2024 | Read the full order here.

GERC approves tariff and ARR for Jubilant Infrastructure Limited for FY 2024–25

The Gujarat Electricity Regulatory Commission (GERC) has issued its final order on the petition filed by Jubilant Infrastructure Limited (JIL) for determination of its Aggregate Revenue Requirement (ARR) and tariff for FY 2024–25. The order, issued on 31 March 2025, marks the first full-year tariff approval since JIL operationalised its distribution license in August 2023 within its Special Economic Zone (SEZ) in Vilayat, Bharuch.

JIL, a deemed distribution licensee, projected an ARR of Rs 519.2 million for FY 2024–25. The Commission approved the same after adjusting for a few cost elements, including disallowance of Rs 3 million of power procurement trading margin, which it redirected to O&M expenses. JIL had estimated a revenue surplus of Rs 43.6 million at existing tariffs.

Power procurement was planned through short-term sources. JIL received approval to source 4 MW from Philips Carbon Black Ltd at Rs 5.40/kWh and 3 MW from GMR Energy Trading at Rs 5.10/kWh. The balance would be drawn from Dakshin Gujarat Vij Company Ltd (DGVCL) and power exchanges. Power purchase from DGVCL, with a fixed cost of Rs 530/kVA/month and variable cost of Rs 8.38/kWh, was noted to be costlier than other sources.

The Commission approved energy sales of 70.81 million units with distribution losses capped at 1.34%. JIL’s consumers fall under the High Tension Power (HTP-I) category. Approved energy tariffs are Rs 3.90/kWh for loads between 500–2500 kVA and Rs 4.00/kWh for loads above 2500 kVA, along with applicable Fuel and Power Purchase Price Adjustment (FPPPA) charges.

RPO (Renewable Purchase Obligation) compliance was mandated at 20.70% of total procurement, to be fulfilled via Renewable Energy Certificates (RECs). GERC approved this mode.

Wheeling charges and cross-subsidy surcharges were also finalised. Green tariff introduction was approved in principle.

No public objections were received during the hearing process. The Commission has directed JIL to maintain separate records for generation and distribution and comply with regulatory filings for future years.

Petition No: Case No. 2369 of 2024 | Read the full order here.

GERC approves truing up for FY 2023–24 and ARR for FY 2025–30 for MPSEZ Utilities

The Gujarat Electricity Regulatory Commission (GERC) has issued its tariff order for MPSEZ Utilities Limited (MUL), approving the truing up for FY 2023–24 and final Aggregate Revenue Requirement (ARR) for FY 2025–26 to FY 2029–30. The order also finalizes MUL’s retail supply tariff for FY 2025–26.

The Commission approved the trued-up ARR for FY 2023–24 at Rs 337.95 crore against Rs 1,547.97 crore initially approved. This sharp reduction was primarily due to lower-than-expected power procurement, stemming from reduced consumer demand. MUL recorded actual energy sales of 657.23 million units (MU), significantly lower than the approved 2,604.99 MU. Distribution losses were reported at 2.61%, below the approved 3.21%.

The Commission noted a net revenue surplus of Rs 40.35 crore for FY 2023–24. Including previous surpluses and carrying costs, the consolidated surplus reached Rs 50.84 crore.

For FY 2025–26, the Commission approved MUL’s ARR at Rs 1,445.52 crore. With revenue from existing tariffs estimated at Rs 1,437.85 crore and considering the carry-forward surplus of Rs 50.84 crore, a revenue surplus of Rs 43.17 crore is projected. Therefore, no tariff increase has been approved for FY 2025–26.

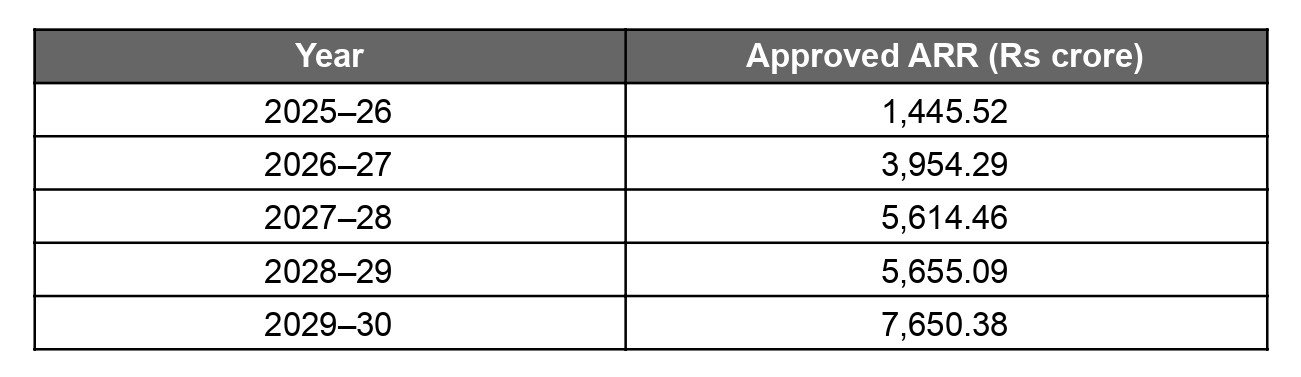

Approved ARR projections for the control period are as follows:

The Commission also approved wheeling charges and cross-subsidy surcharge for FY 2025–26. No objections were received during the public consultation process.

This order has been passed under the GERC Multi-Year Tariff (MYT) Regulations, 2016 and 2024.

Petition No: Case No. 2430 of 2024 | Read the full order here.

GERC finalizes tariff for Deendayal Port Authority for FY 2024–25

The Gujarat Electricity Regulatory Commission (GERC) has issued a tariff order for Deendayal Port Authority (DPA), approving the truing up for FY 2021–22 and FY 2022–23 and determining the Aggregate Revenue Requirement (ARR) and retail tariff for FY 2024–25.

For FY 2021–22, DPA reported actual energy sales of 284.49 lakh units (LU), higher than the approved 263.87 LU. Distribution loss was maintained at 5.00%. The Commission approved a power purchase of 313.69 LU at a total cost of Rs 145.85 million, which was higher than the approved Rs 126.41 million. The Commission accepted this as an uncontrollable factor. The revised ARR for FY 2021–22 stood at Rs 218.22 million, and with revenue of Rs 235.48 million, a surplus of Rs 17.26 million was recorded.

For FY 2022–23, sales stood at 257.24 LU against the approved 266.39 LU. Power purchase costs dropped to Rs 119.59 million. The Commission approved a revised ARR of Rs 302.91 million, with a recorded revenue of Rs 267.21 million, resulting in a revenue gap of Rs 35.70 million.

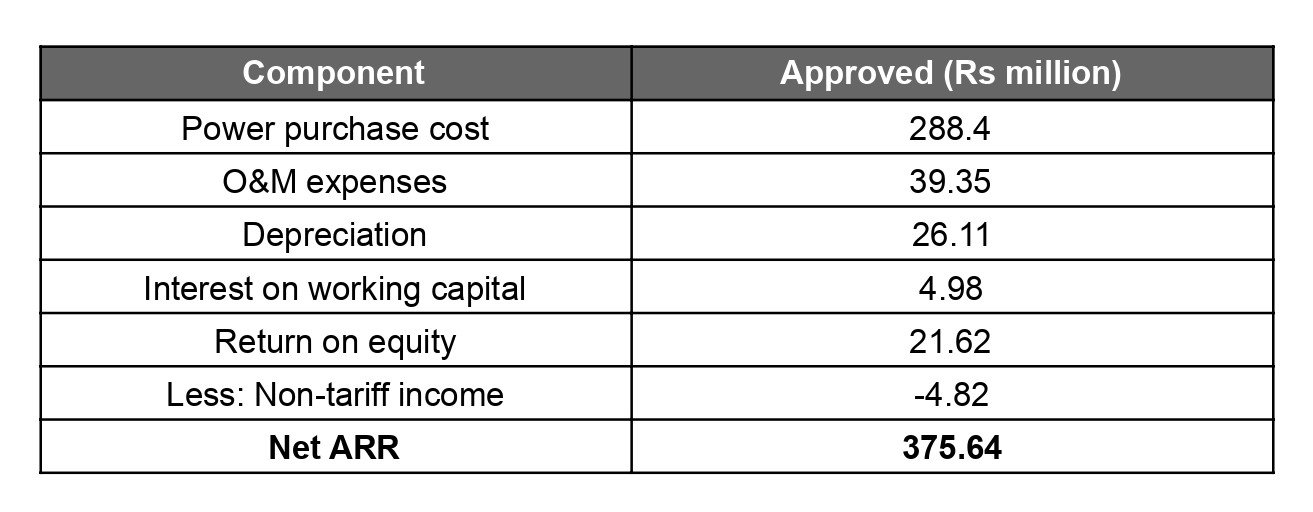

The approved ARR for FY 2024–25 is Rs 375.64 million. After accounting for the surplus of FY 2021–22 and gap from FY 2022–23, the net revenue requirement for FY 2024–25 is Rs 394.08 million. With projected revenue of Rs 383.36 million at existing tariff, a gap of Rs 10.73 million is expected. However, the Commission has not approved any tariff increase. DPA will continue with its existing tariff structure.

Approved ARR for FY 2024–25:

Petition No: Case No. 2370 of 2024 | Read the full order here.

APSERC approves tariff for APDoP for FY 2025–26 and ARR till FY 2029–30

The Arunachal Pradesh State Electricity Regulatory Commission (APSERC) has approved the true-up for FY 2023–24, annual performance review (APR) for FY 2024–25, and final tariff and Aggregate Revenue Requirement (ARR) for FY 2025–26. It also approved the business plan and ARR for the MYT (Multi Year Tariff) control period from FY 2025–26 to FY 2029–30 for the Department of Power, Arunachal Pradesh (APDoP).

For FY 2023–24, APDoP recorded total energy sales of 1,057.15 million units (MU) and power purchase cost of Rs 489.16 crore. Including intra-state and inter-state charges and other O&M costs, the total revenue requirement was Rs 988.81 crore. The average cost of supply (ACS) stood at Rs 6.27/kWh. After accounting for revenue from sale of surplus power, APDoP faced a gap of Rs 590.93 crore, funded through a state government grant.

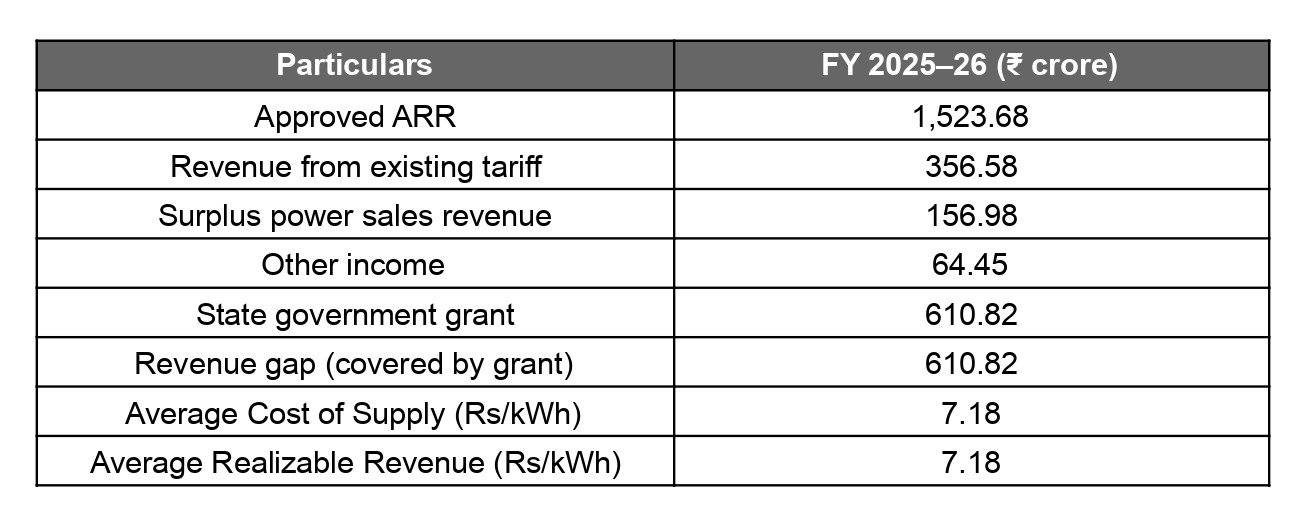

The approved ARR for FY 2025–26 is Rs 1,603.85 crore. The estimated revenue at the existing tariff is Rs 399.88 crore, and surplus power sale revenue is Rs 164.83 crore. A government grant will cover the resulting gap of Rs 1,039.14 crore, avoiding any tariff increase for FY 2025–26. APSERC also projected ARR figures for the remaining MYT control period:

Petition No: TP-0l-2025 & Petition No. MP 10 OF 2024 | Read the full order here.

MPERC approves 5.31% tariff hike for MPIDC SEZ Pithampur in FY 2025–26

The Madhya Pradesh Electricity Regulatory Commission (MPERC) has approved an Aggregate Revenue Requirement (ARR) of Rs 241.84 crore for the Madhya Pradesh Industrial Development Corporation (MPIDC) for its Special Economic Zone (SEZ) at Pithampur, Indore, for the fiscal year 2025–26. This order follows the petition filed under Petition No. 73/2024.

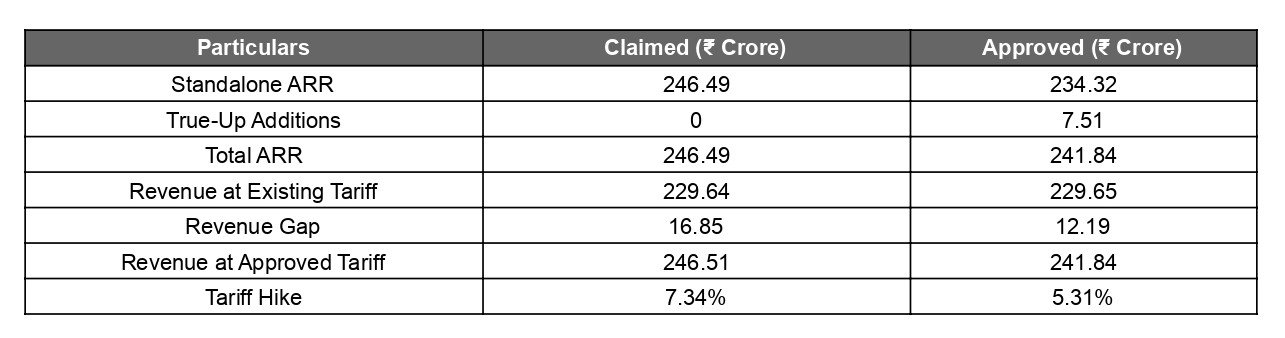

The Commission admitted the standalone ARR of Rs 234.32 crore, which includes prudent expenses such as power purchase cost, transmission charges, operation and maintenance, and depreciation. Additional revenue gaps from approved true-ups for FY 2023–24 amounting to Rs 7.51 crore (Rs 6.84 crore for MP Transco and Rs 0.67 crore for MPIDC) brought the total ARR to Rs 241.84 crore.

MPIDC projected a revenue of Rs 229.65 crore at the existing tariff, leading to a revenue gap of Rs 12.19 crore. To bridge this, MPERC approved a 5.31% tariff hike, slightly lower than the 7.34% hike sought by the petitioner.

The approved ARR and tariff proposal are summarised below:

Petition No: 73/2024 | Read the full order here.

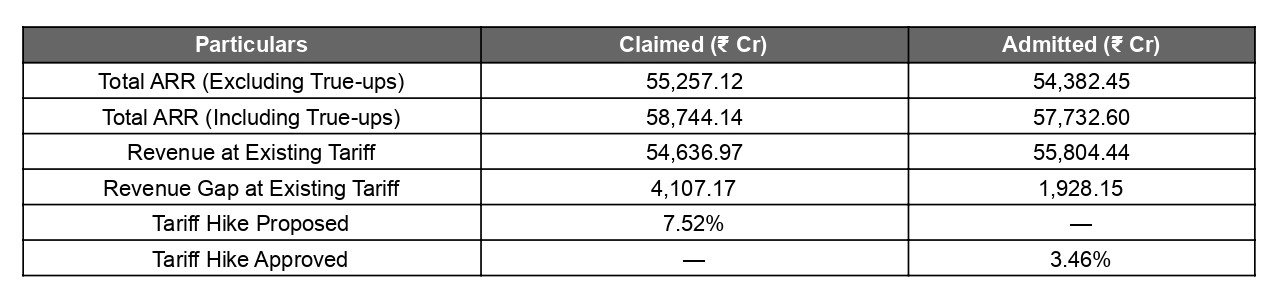

MPERC approves Rs 57,732.60 crore ARR for FY 2025–26 with 3.46% tariff hike for DISCOMs

The Madhya Pradesh Electricity Regulatory Commission (MPERC) has approved the Aggregate Revenue Requirement (ARR) and retail supply tariff for FY 2025–26 for the three state DISCOMs—East, West, and Central—along with MP Power Management Company Limited (MPPMCL). The approved ARR stands at Rs 57,732.60 crore, with a tariff hike of 3.46% to bridge a revenue gap of Rs 1,928.15 crore.

Originally, the DISCOMs had proposed an ARR of Rs 58,744.14 crore and a 7.52% tariff hike to cover a projected revenue gap of Rs 4,107.17 crore. However, MPERC admitted only prudent costs under regulatory norms and disallowed expenses attributed to inefficiencies, particularly citing high distribution losses in East and Central DISCOMs.

The table below summarizes the key financials:

The Commission emphasized improved metering and loss reduction, especially noting that distribution losses in FY 2023–24 were 28.04% for East DISCOM and 25.70% for Central DISCOM—significantly above the regulatory target of 17%. In contrast, West DISCOM outperformed its target with 12.33% losses against the 13% benchmark.

MPERC also expressed concern over the slow pace of meterisation in rural and agricultural areas. Only 13.9% of agricultural distribution transformers across the state have meters installed. The Commission reiterated its directive for DISCOMs to expedite energy audits, adhere to Renewable Purchase Obligations (RPO), and improve operational efficiency under the RDSS (Revamped Distribution Sector Scheme).

Petition No: 72/2024 | Read the full order here.

UPERC clarifies no fees for compensation-related complaints under Standard of Performance Regulations

The Uttar Pradesh Electricity Regulatory Commission (UPERC) has issued an important order stating that consumers will no longer need to pay fees when filing complaints related to compensation under the Standard of Performance Regulations, 2019. This decision resolves a conflict between two regulations—the Consumer Grievance Redressal Forum (CGRF) Regulations, 2022, which mandated fees for complaints, and the Standard of Performance Regulations, 2019, which did not prescribe any fees for compensation-related grievances.

The issue arose after consumers and the Electricity Ombudsman raised concerns about CGRFs charging fees for compensation claims, even though there was no such provision in the Standard of Performance Regulations. In response, UPERC exercised its Power to Remove Difficulties under Regulation 9 of the CGRF Regulations, 2022, to resolve this inconsistency. The Commission’s new order explicitly states that no fee shall be payable by any consumer, regardless of category or contracted load, when approaching CGRFs for compensation-related grievances.

This clarification ensures fair and free access to grievance redressal, particularly when licensees fail to provide mandated compensation within 45 days. The order is effective immediately, while all other provisions of the CGRF Regulations, 2022, remain unchanged.

Read the full order here.

WBERC issues APR order for DVC for FY21

The West Bengal Electricity Regulatory Commission (WBERC) issued its final order on March 29, 2025, for the Annual Performance Review (APR) of Damodar Valley Corporation (DVC) for the financial year 2020–21. The review addresses key elements in power distribution and retail supply, adjusting gaps between projected and actual performance while setting compliance directions.

DVC, a deemed distribution licensee, supplies electricity in West Bengal’s Damodar Valley region, including to entities like West Bengal State Electricity Distribution Company Limited (WBSEDCL) and India Power Corporation Limited (IPCL). The APR reviewed fixed charges, transmission and distribution (T&D) losses, and renewable energy obligations. While DVC reported a composite T&D loss of 2.18%, the Commission revised this to 1.79%, within the approved ceiling of 2.75%. The order also assessed power purchase costs, including renewable energy used to meet Renewable Purchase Obligation (RPO) targets.

One key issue was DVC’s request to recover full contributions to the Pension & Gratuity Fund and the Sinking Fund. The Commission denied this request, aligning with norms set by the Central Electricity Regulatory Commission (CERC). It accepted only delayed payment surcharges (DPS) as non-tariff income, rejecting other streams such as interest and dividends. The Commission admitted partial claims related to legal expenses and regulatory fees but disallowed interest on temporary financial support due to lack of sufficient evidence.

The order allows DVC to recover revenue gaps in future tariff orders, avoiding immediate cost impact on consumers. It also requires DVC to submit detailed data on wheeling charges, CERC-related fee recoveries, and legal expenses in future filings.

Petition No: APR-123/24-25 | Read the full order here.

WBERC finalizes DVC’s APR for FY22

The West Bengal Electricity Regulatory Commission (WBERC) has issued its order on the Annual Performance Review (APR) of Damodar Valley Corporation (DVC) for the financial year 2021–22 under Case No. APR-125/24-25. The review, conducted under the Multi-Year Tariff framework, assessed DVC’s electricity distribution and retail supply performance in West Bengal.

The Commission evaluated DVC’s claims on fixed charges, power purchase costs, and compliance with renewable energy obligations. It confirmed the actual composite transmission and distribution (T&D) loss at 1.79%, below the approved ceiling of 2.75%. The order examined DVC’s procurement from central sector stations, renewable sources, and power exchanges to meet Renewable Purchase Obligation (RPO) targets.

Recoverable fixed charges were determined based on actual plant availability, following Central Electricity Regulatory Commission (CERC) tariff norms. The Commission approved ash disposal expenses but rejected full sinking fund claims that lacked linkage to availability. Solar power purchases and Renewable Energy Certificates (RECs) were allowed as part of RPO compliance.

A revenue gap of Rs 529.68 million was identified for West Bengal consumers after accounting for Rs 2,278.51 million from supply to WBSEDCL and Rs 435.75 million from supply to IPCL. Adjustments for differential Annual Fixed Charges (AFC) and interest from FY15 to FY17 increased the total recoverable amount from consumers to Rs 4,594.89 million.

In line with Regulation 2.6.6 of the Tariff Regulations, the Commission directed that this amount be adjusted in future Aggregate Revenue Requirements or through a separate order. DVC has been instructed to reflect any further adjustments from pending CERC true-up orders in its next APR filing.

Petition No: APR-125/24-25 | Read the full order here.

WBERC sets Rs 6/kWh average tariff for DVC for FY26, introduces green tariff

The West Bengal Electricity Regulatory Commission (WBERC) has issued the tariff order for Damodar Valley Corporation (DVC) for the financial year 2025–26. The order, dated March 31, 2025, sets an average retail tariff of Rs 6.00 per kWh for DVC’s consumers in West Bengal. It follows DVC’s application under the Multi-Year Tariff (MYT) framework for its distribution and retail supply business.

The Commission approved an Aggregate Revenue Requirement (ARR) of Rs 59.31 billion for FY26. It also allowed adjustments for past revenue gaps amounting to Rs 12.68 billion. Carrying costs were admitted at 11.50%, based on the State Bank of India’s Marginal Cost of Funds-Based Lending Rate (MCLR) plus 250 basis points.

The order introduced a green tariff of 50 paise per kWh for consumers opting for renewable energy, subject to a minimum commitment of 25% green power consumption over six months. Promotional tariffs for electric vehicle (EV) charging stations were retained at Rs 6.00 per kWh during peak hours (5 PM to 11 PM) and Rs 5.50 per kWh during off-peak hours.

For captive power plants, parallel operation charges were fixed at Rs 20 per kVA per month. The Commission directed DVC to ensure transparency in billing by disclosing government subsidies and green tariff charges separately.

DVC has also been instructed to address discrepancies in traction load sales and to submit detailed data on demand charges in its next Annual Performance Review (APR). Existing agreements with radial supply licensees remain unchanged, with future negotiations left to the involved parties.

Petition No: TP-104/22-23 | Read the full order here.

KERC approves retail tariff and revenue requirement for MSEZL for FY2025–28

The Karnataka Electricity Regulatory Commission (KERC) has approved the Annual Performance Review (APR) for FY2023–24 and finalized the Annual Revenue Requirement (ARR) and retail supply tariff for Mangalore SEZ Limited (MSEZL) for the control period FY2025–26 to FY2027–28. The order was passed on March 27, 2025.

MSEZL, a deemed distribution licensee under the SEZ Act, filed its petition on November 28, 2024. It sought approval for its revised ARR for FY24 based on audited accounts, load forecast, sales plan, power purchase strategy, and tariff proposals for the multi-year tariff (MYT) period.

For FY2023–24, the Commission approved a revised ARR of Rs 56.47 crore against MSEZL’s revenue of Rs 59.46 crore, resulting in a surplus of Rs 2.99 crore. This surplus is to be carried forward to FY2025–26. The Commission also revised the power purchase cost to Rs 41.76 crore for FY24 and directed MESCOM to reimburse Rs 2.83 crore to MSEZL due to excess charges collected.

The Commission approved MSEZL’s actual energy sales of 70.97 MU and noted a reduction in distribution losses to 0.35%. It also validated MSEZL’s compliance with Renewable Purchase Obligation (RPO) targets for FY24, including adjustment of excess renewable energy purchase against MESCOM’s shortfall.

For the control period FY2025–28, KERC reviewed and approved MSEZL’s projected sales, capital investment of Rs 3.5 crore, and power procurement plans. The approved O&M expenses, depreciation, return on equity, and finance charges were finalized based on normative parameters and audited accounts.

Tariff-related objections raised during public consultation were addressed, with KERC clarifying that wheeling and additional surcharges were calculated as per regulations. It ruled out excess recovery claims and noted that tariff parity with comparable consumers outside the SEZ has been maintained.

Petition No: OP NO.35/2024 | Read the full order here.

KERC approves ARR and retail tariff for AEQUS SEZ for FY2025–28

The Karnataka Electricity Regulatory Commission (KERC) has approved the Annual Performance Review (APR) for FY2023–24 and finalized the Annual Revenue Requirement (ARR) and retail supply tariff for AEQUS SEZ for the control period FY2025–26 to FY2027–28. The order was issued on March 27, 2025.

AEQUS SEZ, a deemed distribution licensee under the SEZ Act, filed its petition on November 28, 2024, seeking approval of the revised ARR for FY2023–24 and determination of the retail tariff for the multi-year period. The Commission approved actual sales of 32.37 MU and recognized a power purchase quantum of 33.53 MU at a cost of Rs 20.935 crore. This resulted in a revenue surplus of Rs 4.141 crore for FY2023–24, which is to be carried forward to FY2025–26.

AEQUS had reported a distribution loss of 3.47%, exceeding the approved target of 3.00%, but the Commission accepted this figure without penalty. The Commission also validated the capital expenditure of Rs 1.54 crore and confirmed AEQUS’ compliance with Renewable Purchase Obligation (RPO) targets for FY2023–24.

For the control period FY2025–28, the Commission approved projected sales of 32.99 MU, 33.62 MU, and 34.28 MU respectively. Capital investments of Rs 1.29 crore, Rs 1.05 crore, and Rs 1.05 crore were also approved. Power purchase costs were determined at Rs 22.34 crore for FY2025–26, Rs 22.44 crore for FY2026–27, and Rs 22.81 crore for FY2027–28.

The Commission considered normative parameters to determine allowable expenses including O&M costs, depreciation, and return on equity. It also reviewed AEQUS’ proposal to revisit power purchase cost methodology and acknowledged their concerns regarding equitable tariff treatment for SEZ consumers.

Petition No: OP NO.36/2024 | Read the full order here.

KERC approves ARR and retail tariff for Hukeri Rural Electric Co-operative Society for FY2025–28

The Karnataka Electricity Regulatory Commission (KERC) has approved the Annual Performance Review (APR) for FY2023–24 and the Annual Revenue Requirement (ARR) and retail supply tariff for the Hukeri Rural Electric Co-operative Society (HRECS) for the control period FY2025–26 to FY2027–28. The order was issued on March 27, 2025.

HRECS, the only co-operative society functioning as a power distribution licensee in Karnataka, had filed the tariff petition on November 29, 2024. It reported total energy sales of 436.18 MU in FY2023–24, with a notable increase in consumption from irrigation pump sets (IP sets) attributed to drought conditions. The Commission approved 414.50 MU of retail sales (excluding AEQUS SEZ), including 286.61 MU from IP sets, and recognized the impact of additional demand due to monsoon failure.

The Commission approved power purchase cost of Rs 298.98 crore and determined that distribution losses stood at 14.13%, exceeding the target of 13.75%. Consequently, KERC imposed a penalty of Rs 0.46 crore on HRECS for higher-than-approved losses. Operating expenses were allowed at Rs 20.62 crore based on normative parameters, lower than the actual claim of Rs 23.81 crore. The approved interest on working capital was Rs 3.32 crore, and depreciation was Rs 3.35 crore. No return on equity was allowed due to negative net worth.

HRECS reported a revenue deficit of Rs 10.09 crore for FY2023–24. The Commission carried this forward to FY2025–26 and approved the revised ARR for FY2023–24 at Rs 353.68 crore.

Petition No: OP NO.37/2024 | Read the full order here.

KERC approves tariff hike and multi-year plan for ESCOMs in Karnataka

The Karnataka Electricity Regulatory Commission (KERC) has approved a revised retail electricity tariff and multi-year revenue plan for the state’s five electricity supply companies (ESCOMs) — BESCOM, MESCOM, CESC, HESCOM, and GESCOM — covering the control period from FY2025-26 to FY2027-28. This comes after a comprehensive Annual Performance Review (APR) for FY2023-24, which revealed a combined revenue deficit of Rs 781.94 crore.

The tariff order, issued on March 27, 2025, follows detailed scrutiny of audited financials, public consultations, and stakeholder hearings. The ESCOMs had sought tariff hikes citing rising power purchase costs, operational expenses, employee pay revisions, and growing pension and gratuity obligations. While acknowledging these cost pressures, the Commission reviewed their capital investments, energy sales forecasts, and efficiency targets, before finalizing a revised Annual Revenue Requirement (ARR) and deficit recovery mechanism.

For the upcoming control period, the Commission approved projected revenue gaps of Rs 1,090.88 crore, Rs 1,313.92 crore, and Rs 1,879.69 crore respectively for FY2025-26, FY2026-27, and FY2027-28. The deficits are to be recovered through tariff adjustments across all consumer categories, with changes effective from April 1, 2025.

The order continues the policy of uniform tariffs across the state, ensuring cross-subsidization from industrial and commercial users to support agricultural and low-income segments. However, the Commission stressed the need to reduce cross-subsidies gradually in line with national tariff policy.

Key consumer concerns raised during the hearings included the fairness of grid support charges, the design of the time-of-day (ToD) tariff, and the treatment of government subsidy write-offs. The Commission rejected BESCOM’s proposed ToD rebate during solar hours, citing grid stability issues.

Further, KERC directed ESCOMs to enhance reliability reporting, reduce distribution losses, and improve transparency in energy accounting. Emphasis was also placed on regular feeder audits and improved digital data integration via the URJA Mitra platform.

Read the full order here.

HPERC approves ARR and tariff for FY 2025-26 for HPSEBL; finalizes true-up for FY23 and FY24

The Himachal Pradesh Electricity Regulatory Commission (HPERC) has approved the Aggregate Revenue Requirement (ARR) and tariff for FY 2025-26 for the distribution business of Himachal Pradesh State Electricity Board Limited (HPSEBL). This comprehensive tariff order also includes the final true-up for uncontrollable parameters for FY 2022-23, provisional true-up for FY 2023-24, and true-up of controllable parameters for the 4th MYT Control Period (FY 2020-24).

Filed under Petition No. 156/2024, the order marks the first Annual Performance Review (APR) for the 5th MYT Control Period (FY 2024-29). HPERC determined the ARR based on actual and projected data, statutory guidelines under Sections 62, 64, and 86 of the Electricity Act, 2003, and its own MYT Regulations, 2011 and 2023.

For FY 2025-26, the Commission approved an ARR of Rs 7,330.76 crore after adjustments. The tariff revision will be effective from April 1, 2025, and will remain in force until March 31, 2026, unless amended or revoked. The approved wheeling charges, cross-subsidy surcharge, and additional surcharge for open access consumers were also finalized.

The Commission observed underperformance in achieving the approved Transmission and Distribution (T&D) loss targets for both FY 2022-23 and FY 2023-24, resulting in disincentives imposed on HPSEBL. It also noted high employee costs and emphasized the need for operational efficiency.

As per regulatory directives, HPSEBL must publish the tariff in English and local dailies by April 7, 2025, and make the tariff schedule available online and at its offices. The utility is also required to distribute the order to all relevant field officers by April 20, 2025.

The order includes detailed directions on future compliance and allows HPSEBL to file clarification petitions within 30 days if needed.

Petition No: 156/2024 | Read the full order here.

AERC approves true-up, APR, ARR, and tariff without tariff hike

The Assam Electricity Regulatory Commission (AERC) has issued its latest tariff order for Assam Power Distribution Company Limited (APDCL), covering the true-up for FY 2023-24, Annual Performance Review (APR) for FY 2024-25, Aggregate Revenue Requirement (ARR) for FY 2025-26 to FY 2029-30, and tariff determination for FY 2025-26. The Commission approved all filings, while notably deciding to maintain the existing tariff for consumers in FY 2025-26 despite a cumulative revenue shortfall.

For FY 2023-24, AERC completed the true-up based on audited financials submitted by APDCL. A significant increase in power purchase cost, from the approved Rs 6,409.29 crore to Rs 8,481.15 crore, contributed to an overall ARR of Rs 10,418.07 crore. With revenue, grants, and subsidies considered, the Commission acknowledged a net revenue gap of Rs 440 crore. Other approved adjustments included operation and maintenance (O&M) expenses of Rs 1,370 crore and a return on equity (RoE) of Rs 222.90 crore. The Commission also accepted partial efficiency losses related to higher-than-approved distribution losses.

In the APR for FY 2024-25, AERC assessed mid-year performance based on actual data from the first half and projections for the second half. Total expenses were reported at Rs 11,625.81 crore, with revenue projections at Rs 11,186.22 crore, leading to a revenue gap of Rs 109.57 crore. APDCL projected significant other income, including Rs 855.59 crore from consumer-related sources. Key changes included rising interest and finance charges and an RoE of Rs 297.14 crore.

For the next five-year control period, APDCL proposed an ARR that rises from Rs 11,109 crore in FY 2025-26 to Rs 15,793 crore in FY 2029-30. Power purchase expenses will remain the largest cost element, peaking at Rs 12,408.94 crore in FY 2029-30. The Commission approved a detailed capital investment plan covering smart metering under RDSS, system enhancement projects, renewable energy-backed battery storage, and urban underground cabling. Approved investments aim to enhance reliability and reduce losses, with a focus on Guwahati and rural electrification.

Despite a projected cumulative revenue gap of Rs 543.33 crore for FY 2025-26, including carrying costs from prior years, APDCL did not seek a tariff increase. The Commission accepted this, with the average cost of supply rising to Rs 9.70/kWh from Rs 9.55/kWh. Tariffs for all consumer categories remain unchanged for the year, reflecting a policy decision to shield consumers from additional burden.

The Commission also revised wheeling charges and cross-subsidy surcharges applicable to open access consumers and introduced updated green tariff and standby charges.

Petition No: 21/2024 | Read the full order here.

APTEL strikes down APERC’s 2017-18 tariff order over cross-subsidy violations

The Appellate Tribunal for Electricity (APTEL) has annulled Andhra Pradesh’s 2017-18 electricity tariff order, citing improper allocation of fixed power purchase costs that led to excessive cross-subsidies for agricultural consumers. The ruling found the Andhra Pradesh Electricity Regulatory Commission (APERC) deviated from its stated methodology and failed to justify cost shifts with data.

APTEL noted that while APERC claimed to waive 40% of fixed costs for agricultural users, it effectively waived 60%, increasing the burden on industrial and domestic consumers. The Andhra Pradesh Spinning Mills Association had challenged the order in Appeal No. 199 of 2017, citing non-compliance with the National Tariff Policy’s ±20% cross-subsidy band.

The tribunal found that domestic users were charged well below the 80% cost of supply threshold, with actual recovery ranging from 60% to 63%. It termed the agricultural cost adjustment “irrational and baseless,” lacking evidence and contrary to the Electricity Act, 2003.

APERC has been directed to recalculate tariffs within three months, in line with statutory and policy guidelines.

Petition No: 199 of 2017 | Read the full order here.

JSERC directs Jindal Steel to approach CGRF for billing dispute with DVC

The Jharkhand State Electricity Regulatory Commission (JSERC) has dismissed the petition filed by Jindal Steel & Power Ltd. (JSPL) against Damodar Valley Corporation (DVC), citing lack of jurisdiction. JSPL had sought clarification on para 41(a) and 41(c) of the Commission’s Tariff Order dated 10 December 2024, specifically on whether it directed any recovery beyond reporting of consumer-wise principal amounts.

JSPL contended that the tariff order only mandated reporting and that any recovery must follow legal procedures. However, DVC argued that the matter constituted a billing dispute and should be adjudicated by the Consumer Grievance Redressal Forum (CGRF) under Section 42(5) of the Electricity Act, 2003.

The Commission reviewed the submissions and held that the 10 December 2024 Tariff Order was consistent with the Appellate Tribunal for Electricity’s (APTEL) earlier order dated 10 May 2010 in Appeal No. 146 of 2009. It observed that JSPL’s plea pertained to billing and, as per Clause 8.2.2 of the JSERC (Electricity Supply Code) Regulations, 2015, such disputes must be referred to the CGRF.

The case was deemed not maintainable and dismissed accordingly. However, JSERC directed that JSPL’s electricity connection should not be disconnected until it files an application before the CGRF.

Petition No: 04 of 2025 | Read the full order here.

For more regulatory updates, read the latest orders covered on Power Peak Digest: Energy Regulatory Updates – Power Peak Digest

Featured photograph is for representation only.