National power distribution ratings show sector-wide gains

Author: PPD Team Date: January 27, 2026

The Union Ministry of Power has released the 14th Annual Integrated Ratings and Rankings of power distribution companies, covering performance in FY 2024-25. The assessment, prepared by Power Finance Corporation Ltd. (PFC), reviews 65 private and state-owned distribution utilities and points to broad improvement in operational efficiency and financial outcomes across the sector.

The rating framework evaluates utilities on a weighted set of parameters covering financial sustainability, operational performance, and the external environment. According to the report, several utilities recorded stronger scores compared to the previous cycle, indicating gradual consolidation in the distribution sector performance.

Torrent Power Ltd. ranked first nationally in the latest assessment. Its licensed distribution areas in Ahmedabad and Surat each received a score of 100, placing them jointly at the top. The company reported distribution losses below 3% across its licensed areas during FY 2024-25. Torrent Power stated that its performance on parameters such as Transmission and Distribution (T&D) losses, Aggregate Technical and Commercial (AT&C) losses, and supply reliability aligned with international benchmarks. Jinal Mehta, Vice Chairman of Torrent Power, said the ranking reflected the company’s operational discipline, customer focus, and governance practices.

Tata Power-led distribution utilities in Odisha also featured prominently in the national rankings. TP Northern Odisha Distribution Limited (TPNODL) secured the 9th position among all rated utilities. TPNODL and TP Central Odisha Distribution Limited (TPCODL) retained an A+ grade, while TP Western Odisha Distribution Limited (TPWODL) received an A grade. This marks the third consecutive year of high ratings for these utilities. Gajanan Kale, Chief of Odisha Distribution Business and Chief Executive Officer of TPNODL, said the results validated their approach to improving efficiency through digital systems and network upgrades while keeping consumer needs central.

At the national level, the report highlights measurable progress across multiple indicators. Twenty-two utilities, including 18 distribution companies and four Power Departments (PDs), improved their ratings compared to the Thirteenth Integrated Rating, while ten utilities were downgraded. Thirty-one utilities achieved A+ or A grades, while 11 were rated C or C-. Fifteen utilities scored A+, defined as a score of 85 or above. These included Adani Electricity Mumbai Ltd., which scored 99.75, four state-owned utilities from Gujarat, and PDs such as BEST Undertaking, Mumbai, and New Delhi Municipal Council (NDMC).

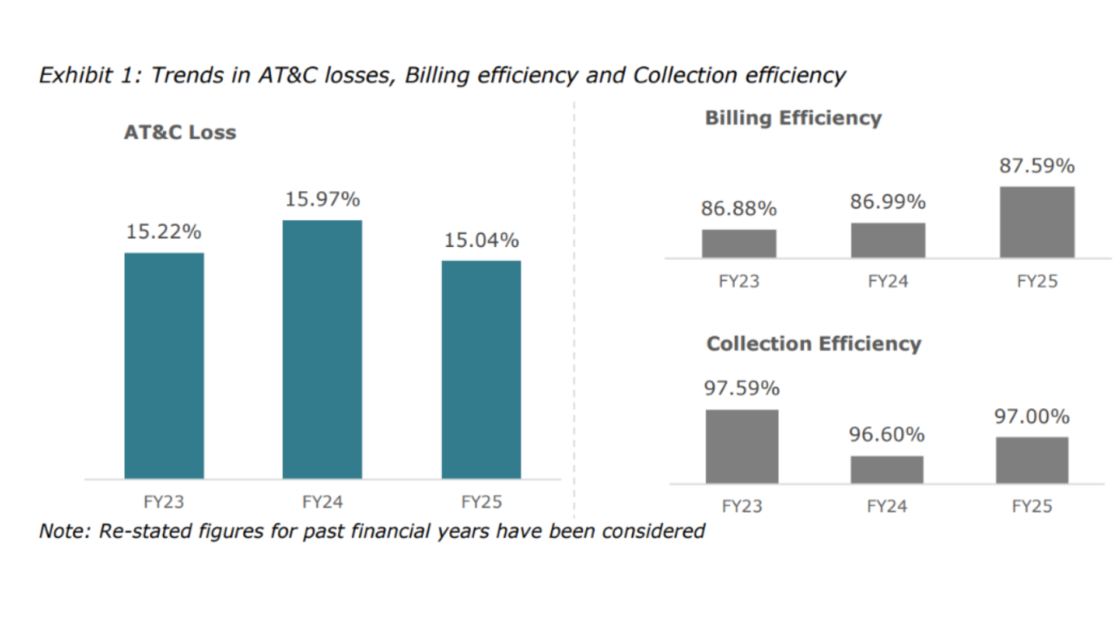

Operational performance also showed improvement. National AT&C losses declined from 15.97% in FY24 to 15.04% in FY25. Billing efficiency increased from 86.99% to 87.59%, with 46 of the 65 rated utilities reporting gains. Collection efficiency rose to 97.00% in FY25 from 96.60% in the previous year, and 17 utilities achieved 100% collection efficiency.

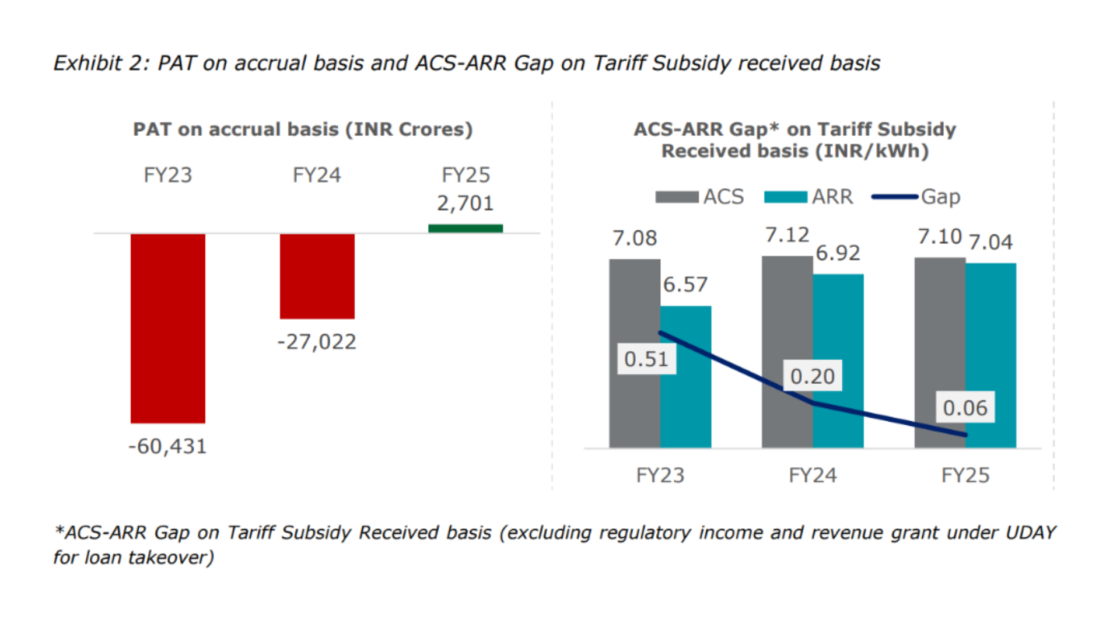

On the financial side, distribution utilities collectively reported a Profit After Tax (PAT) of Rs 2,701 crore in FY25, reversing a loss of Rs 27,022 crore in FY24. The gap between Average Cost of Supply and Average Revenue Realised (ACS-ARR) narrowed to Rs 0.07 per kWh from Rs 0.25. The report covered 65 of India’s 72 power distribution utilities, with seven utilities not rated.

The Ministry of Power noted that the integrated rating exercise remains a key benchmarking tool for tracking reforms and identifying best practices in the distribution segment. The FY 2024-25 results indicate a gradual shift toward improved efficiency, tighter financial control, and more consistent service delivery across India’s power distribution sector.