Union Budget 2026 signals shift in energy, manufacturing and infrastructure policy

Author: PPD Team Date: February 2, 2026

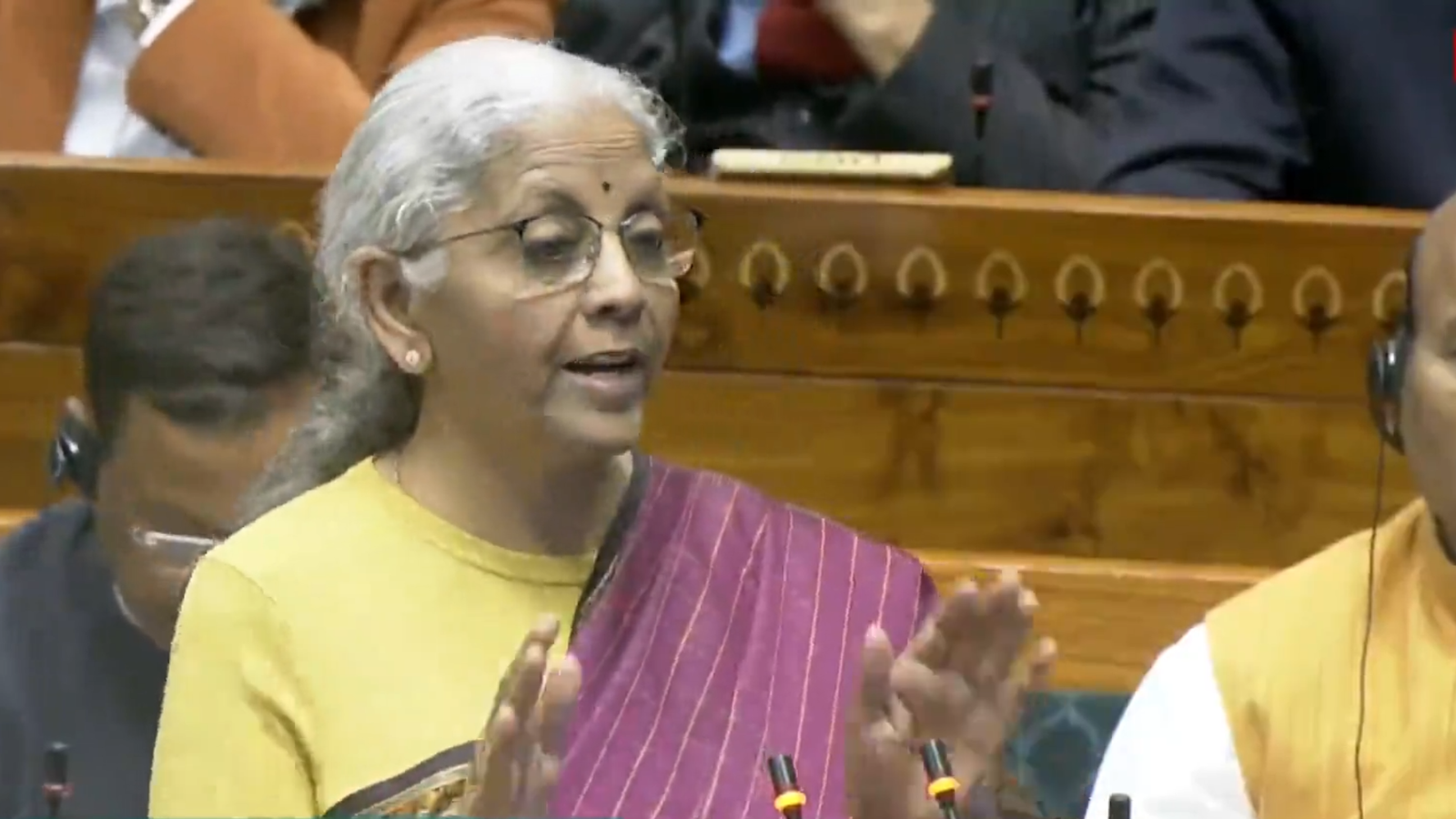

The Union Budget for 2026–27, presented by Finance Minister Nirmala Sitharaman on Sunday, 1 February 2026, unveiled a fiscal plan for strengthening India’s domestic manufacturing base, particularly in renewable energy and critical mineral processing. The budget features a series of targeted customs duty exemptions, new sectoral incentives, and strategic infrastructure initiatives designed to reduce input costs, attract investment, and enhance supply chain resilience for key industries vital to the nation’s energy transition and technological self-reliance.

Focus on customs duty rationalisation

A major theme in the budget is the use of customs duty changes to reduce manufacturing costs while narrowing exemptions that no longer serve policy objectives. The government extended the basic customs duty exemption on capital goods used for manufacturing lithium-ion cells for battery storage. The extension applies to the next financial year and lowers upfront capital costs for companies expanding domestic battery capacity.

In solar manufacturing, the budget introduces a full exemption from basic customs duty on sodium antimonate, a specialised chemical used in photovoltaic glass. The duty on the material has been reduced from 7.5% to nil. Sodium antimonate is used in very small quantities during glass production, but plays a critical role in improving optical clarity and yield. Solar glass accounts for roughly 8 to 12% of total module costs, making input quality and consistency important for manufacturers scaling capacity.

India currently relies on imports for sodium antimonate, with supplies concentrated among a few countries. Industry data show Belgium and Italy as the main sources, with limited quantities imported from China. Domestic manufacturers such as Borosil Renewables are among the key users of the material.

The budget also provides a basic customs duty exemption on capital goods required for processing critical minerals in India. This measure is intended to support domestic capabilities across batteries, renewable energy technologies, power equipment, and allied manufacturing that depend on secure mineral supply chains.

At the same time, the government signalled a more selective approach to incentives. Customs duty exemptions will be withdrawn for items that are already manufactured domestically or have negligible import volumes. This marks a shift toward tighter targeting of fiscal support.

Support for cleaner fuels and bio energy

The budget changes the excise duty framework for compressed natural gas blended with biogas. Under the revised structure, the entire value of the biogas component will be excluded when calculating central excise duty on blended CNG. The amendment improves the commercial viability of biogas blending and supports the expansion of compressed biogas usage.

The changes were notified through Notification No. 02/2026–Central Excise, dated 01 February 2026, and take effect from 02 February 2026. Biogas blended CNG has been placed under a new excise category with a duty rate of 14%, while excluding the value of the biogas or compressed biogas component from the taxable base. The exclusion also applies where central or state taxes have already been paid on the bio component.

The budget also extends the validity of an existing excise concession from 2026 to 2028 for a specified category of goods, continuing support for cleaner fuel pathways.

Continued push for nuclear energy

Nuclear energy received renewed policy support through extended and expanded customs duty exemptions. The budget proposes to extend the existing basic customs duty exemption on imports required for nuclear power projects until 2035. The scope of the exemption will be widened to cover all nuclear power plants, regardless of capacity.

In addition, the government proposes to reduce basic customs duty to zero on all goods required for nuclear power generation. This includes critical components such as control rods, protector absorber rods, and burnable absorber rods, which are essential for reactor operations and safety.

The measures align with the government’s stated target of scaling nuclear power capacity to 100 gigawatts by 2047. Lower import costs for specialised equipment are expected to support project execution and long term capacity addition in the sector.

Rare earth corridors and critical minerals strategy

A significant announcement relates to rare earths and critical minerals. The government will set up dedicated rare earth corridors across coastal states including Odisha, Kerala, Andhra Pradesh, and Tamil Nadu. These corridors are intended to support mining, processing, research, and manufacturing activities linked to rare earth elements.

Rare earth production in India is largely associated with beach sand minerals that contain monazite, a phosphate mineral rich in uranium and thorium. Coastal states with such deposits are central to any domestic rare earth strategy.

The proposal aligns with a recently announced scheme to promote manufacturing of sintered rare earth permanent magnets, with a total financial outlay of Rs 7,280 crore. The scheme aims to support 6,000 metric tonnes per annum of integrated magnet manufacturing capacity, allocated among five beneficiaries through competitive bidding. Sales linked incentives of Rs 6,450 crore over five years and a capital subsidy of Rs 750 crore are planned.

Rare earth magnets are critical inputs for electric vehicles and renewable energy systems. Global manufacturing capacity is highly concentrated, with China accounting for more than 90%. India imported over 53,000 metric tonnes of rare earth magnets in the financial year ended March 2025, and demand is expected to double by 2030.

Power sector finance and institutional restructuring

The budget signals a review of the role of state owned non banking financial companies in the power sector. The government proposes to restructure Power Finance Corporation (PFC) and Rural Electrification Corporation (REC) to improve credit flows, execution capacity, and institutional efficiency.

The announcement has revived speculation around consolidation or structural changes involving the two lenders. Both institutions have significant exposure to power utilities and distribution companies. As borrowing requirements from distribution utilities moderate over time, the lenders may need to expand project financing and infrastructure lending beyond their traditional portfolios.

Market reaction was mixed following the announcement, reflecting uncertainty around the form and timeline of the restructuring.

Carbon capture and emissions reduction

The Centre will launch a new scheme to promote carbon capture, utilisation and storage technologies, with an outlay of Rs 20,000 crore over five years. The scheme will cover the power, steel, cement, refineries, and chemicals sectors, which together account for a large share of industrial emissions.

The budget also provides for the deployment of 4,000 electric buses, with implications for urban electricity demand, charging infrastructure rollout, and distribution network planning.

The incentives are intended to support deployment of cleaner technologies in hard to abate sectors where direct electrification remains challenging. The announcement comes amid a recent slowdown in emissions growth from India’s power sector, attributed to faster deployment of clean energy.

Data centres and long term tax clarity

To capitalise on rising investment in data centres driven by artificial intelligence adoption, the budget proposes a tax holiday until 2047 for foreign companies providing cloud services to global customers using data centres located in India. Services to Indian customers will need to be routed through an Indian reseller entity, and a safe harbour margin of 15% on cost has been proposed where the Indian data centre operator is a related entity.

India’s data centre market is estimated at around $10 billion, with revenues of about $1.2 billion in financial year 2023–24. Industry projections suggest significant capacity addition over the next few years, with direct implications for electricity demand, grid investment, and power sector planning.

Conclusion

The Union Budget 2026–27 uses targeted fiscal tools rather than broad based incentives to support manufacturing, energy transition, and infrastructure. By focusing on input cost reduction, long term policy signals, and sector specific support, the budget seeks to balance competitiveness with fiscal discipline. For the power and energy sectors, the measures reinforce the link between industrial policy, clean energy deployment, and financing structures that will shape investment decisions over the coming decade.